In-Depth Study on Executive Summary Medical Insurance Market Size and Share

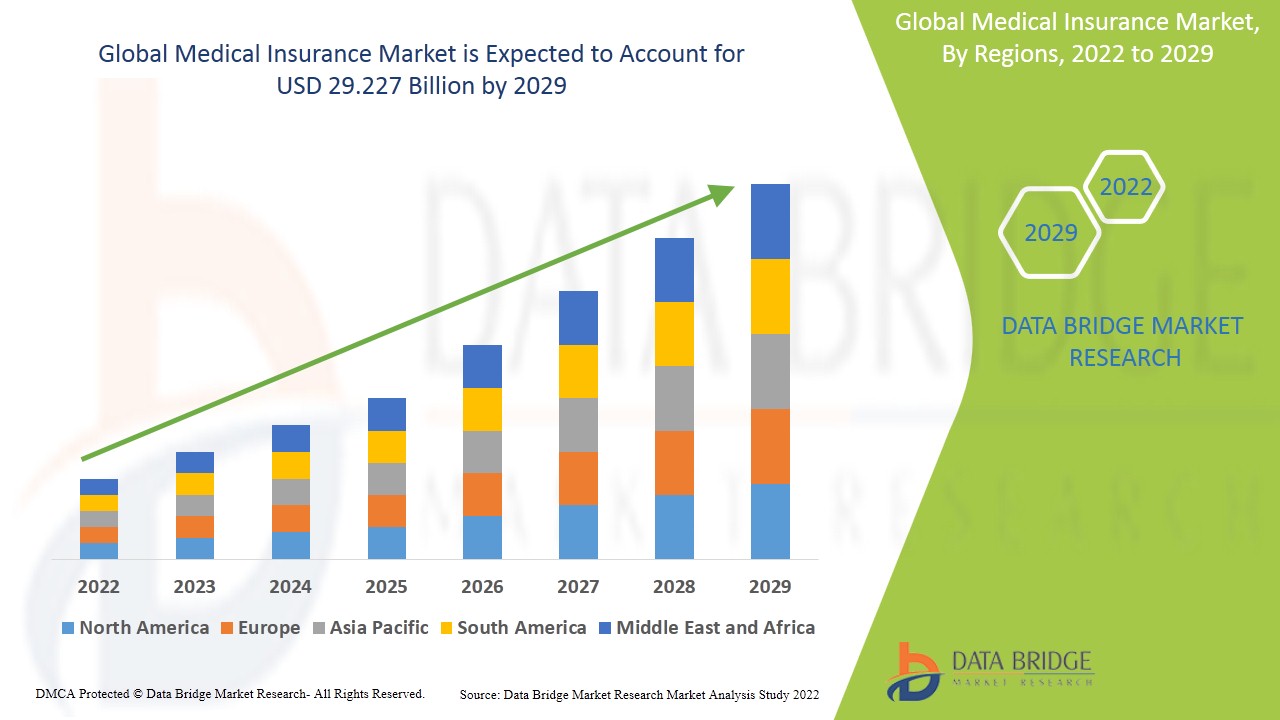

Data Bridge Market Research analyses that the medical insurance market to account USD 29.227 billion by 2029 growing at a CAGR of 10.30% in the forecast period of 2022-2029.

Medical Insurance Market research report contains a key data about the market, emerging trends, product usage, motivating factors for customers and competitors. Medical Insurance Market is a detailed market research report that serves this purpose and gives your business a competitive advantage. This excellent market report evaluates the existing state of the market, market size and market share, revenue generated from the product sale, and essential changes required in the future products. The data included in Medical Insurance Market report not only lends a hand to plan the investment, advertising, promotion, marketing and sales strategy more valuably but also assists in taking sound and efficient decisions.

A skilful set of analysts, statisticians, research experts, forecasters, and economists work carefully to build this Medical Insurance Market research report for the businesses seeking a prospective growth. These parameters mainly include latest trends, market segmentation, new market opening, industry forecasting, target market analysis, future directions, opportunity identification, strategic analysis, insights and innovation. This market research report makes you knowledgeable about strategic analysis of mergers, expansions, acquisitions, partnerships, and investment. Medical Insurance Market research analysis lends a hand to businesses for the planning of production, product launches, costing, inventory, purchasing and marketing strategies.

Uncover strategic insights and future opportunities in the Medical Insurance Market. Access the complete report: https://www.databridgemarketresearch.com/reports/global-medical-insurance-market

Medical Insurance Market Landscape

**Segments**

- By Type: Health Maintenance Organizations (HMOs), Preferred Provider Organizations (PPOs), Exclusive Provider Organizations (EPOs), Point of Service (POS) Plans

- By Coverage: Individual Health Insurance, Family Health Insurance, Group Health Insurance

- By Service Providers: Public Providers, Private Providers

- By Region: North America, Europe, Asia-Pacific, Latin America, Middle East and Africa

The global medical insurance market is segmented based on various factors such as type, coverage, service providers, and region. Health Maintenance Organizations (HMOs), Preferred Provider Organizations (PPOs), Exclusive Provider Organizations (EPOs), and Point of Service (POS) Plans are some of the primary types of medical insurance available in the market. These types offer different coverage and benefits to policyholders depending on their healthcare needs. In terms of coverage, medical insurance can be categorized into individual health insurance, family health insurance, and group health insurance. Various service providers, including both public and private entities, play a crucial role in the distribution and management of medical insurance policies. Geographically, the market is divided into North America, Europe, Asia-Pacific, Latin America, and the Middle East and Africa, each region having its own unique market dynamics and regulatory landscape.

**Market Players**

- Allianz

- AXA

- Nippon Life Insurance Company

- UnitedHealth Group

- Anthem, Inc.

- Aetna Inc.

- Ping An Insurance

- CVS Health

- Zurich Insurance Group

- Berkshire Hathaway

Several key players operate in the global medical insurance market, each with its own competitive strategies and market positioning. Companies such as Allianz, AXA, Nippon Life Insurance Company, and UnitedHealth Group are among the prominent players in the market. These companies offer a wide range of medical insurance products and services to cater to the diverse needs of consumers worldwide. Other notable players in the market include Anthem, Inc., Aetna Inc., Ping An Insurance, CVS Health, Zurich Insurance Group, and Berkshire Hathaway, all of which contribute significantly to the growth and development of the medical insurance sector on a global scale.

The global medical insurance market is witnessing significant growth due to various factors such as rising healthcare costs, increasing awareness about the importance of health insurance, and the growing prevalence of chronic diseases worldwide. In recent years, the market has seen a shift towards more personalized and value-based insurance products that offer tailored coverage based on individual needs and preferences. This trend is driving innovation among market players to develop new and innovative products that meet the evolving needs of consumers. Additionally, the integration of technology such as telemedicine and digital health platforms is shaping the way medical insurance services are delivered and accessed by policyholders.

One of the key trends in the medical insurance market is the increasing focus on preventive care and wellness programs to promote healthy lifestyles and reduce the incidence of chronic diseases. Insurers are investing in initiatives that incentivize policyholders to adopt healthy behaviors through wellness programs, fitness tracking devices, and health coaching services. These proactive measures not only benefit the policyholders in terms of improved health outcomes but also help insurers reduce long-term healthcare costs by preventing costly medical interventions and hospitalizations.

Another important trend in the medical insurance market is the rise of digitalization and the adoption of technology-driven solutions to enhance customer experience and streamline insurance processes. Insurers are leveraging artificial intelligence, machine learning, and data analytics to personalize insurance offerings, automate claims processing, and provide real-time customer support. Digital platforms also enable insurers to gather valuable insights into customer behavior and preferences, helping them tailor their products and services to meet individual needs effectively.

In terms of regulatory landscape, each region has its own set of rules and guidelines governing the medical insurance market. Regulatory requirements related to product offerings, pricing, underwriting practices, and consumer protection measures vary across regions, influencing the competitive dynamics and market entry strategies of insurers. Compliance with regulatory standards is crucial for market players to maintain trust and credibility among policyholders and regulatory authorities, ensuring long-term sustainability and growth in the industry.

Looking ahead, the global medical insurance market is expected to continue expanding, driven by ongoing demographic shifts, increasing healthcare expenditure, and the growing need for comprehensive health coverage. Market players need to adapt to changing consumer preferences, technological advancements, and regulatory developments to stay competitive and meet the evolving needs of policyholders in a rapidly transforming healthcare landscape. Innovation, collaboration, and customer-centricity will be key differentiators for insurers seeking to capitalize on the opportunities presented by the dynamic and evolving medical insurance market.The global medical insurance market is a dynamic and rapidly evolving sector with various factors influencing its growth and development. One key aspect that market players need to consider is the shifting consumer preferences towards personalized and value-based insurance products. Consumers today are seeking tailored coverage that aligns with their individual healthcare needs and preferences. This demand for customization is driving innovation among insurers to develop new products and services that cater to specific demographics and address emerging healthcare trends.

Furthermore, the emphasis on preventive care and wellness programs in the medical insurance market is gaining momentum as insurers recognize the importance of promoting healthy lifestyles and disease prevention. By investing in initiatives that encourage policyholders to adopt healthy behaviors, insurers can not only improve the overall well-being of their customers but also mitigate long-term healthcare costs associated with chronic diseases. This shift towards proactive healthcare management is reshaping the industry landscape and prompting insurers to reevaluate their offerings to better support preventive care measures.

In addition, the increasing adoption of digitalization and technology-driven solutions is reshaping the way medical insurance services are delivered and accessed by consumers. Insurers are leveraging artificial intelligence, machine learning, and data analytics to enhance customer experience, streamline insurance processes, and personalize insurance offerings. Digital platforms enable insurers to gather valuable insights into consumer behavior, allowing them to tailor their products and services effectively and meet the evolving needs of policyholders in a digitally-driven ecosystem.

Moreover, the regulatory landscape plays a crucial role in shaping the competitive dynamics of the medical insurance market across different regions. Regulatory requirements related to product offerings, pricing strategies, underwriting practices, and consumer protection measures vary globally, influencing the market entry strategies and operational practices of insurers. Compliance with regulatory standards is essential for insurers to maintain trust and credibility among policyholders and regulatory authorities, ensuring sustainable growth and long-term success in the industry.

Overall, the global medical insurance market is poised for continued expansion fueled by demographic shifts, rising healthcare expenditures, and the increasing demand for comprehensive health coverage. To navigate this evolving landscape successfully, market players must prioritize innovation, collaboration, and customer-centricity to capitalize on emerging opportunities and stay competitive in a dynamic and transformative market environment. Adapting to changing consumer trends, technological advancements, and regulatory developments will be essential for insurers looking to thrive in the evolving healthcare ecosystem and meet the diverse needs of policyholders worldwide.

View comprehensive company market share data

https://www.databridgemarketresearch.com/reports/global-medical-insurance-market/companies

Global Medical Insurance Market: Strategic Question Framework

- What is the size of the Medical Insurance Market in USD terms?

- What is the estimated annual growth rate of the Medical Insurance Market?

- Which are the main categories studied in the Medical Insurance Market report?

- Who are the primary stakeholders in the Medical Insurance Market?

- Which countries contribute the most to the Medical Insurance Market share?

- Who are the global leaders in the Medical Insurance Market?

Browse More Reports:

Global Diphtheria Market

Global Specialty Polystyrene Resin Market

Global Lung Stent Market

Global Myiasis Treatment Market

Global Virtual Events Platform Market

Europe Antimicrobial Susceptibility Testing Market

Global Residential Hobs Market

Global Wedding Rings Market

Asia-Pacific Lubricating Oil Additives Market

Asia-Pacific Foam Insulation Market

Global Sterile Filtration Market

Global Automotive Heat Seat Market

U.A.E. and Saudi Arabia Men’s Health Market

Global Duloxetine Market

Global Tissue-Engineered Products Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- [email protected]