-

News Feed

- EXPLORE

-

Pages

-

Groups

-

Blogs

-

Developers

Medical Insurance Market Demand: Growth, Share, Value, Size, and Insights By 2029

Executive Summary: Medical Insurance Market Size and Share by Application & Industry

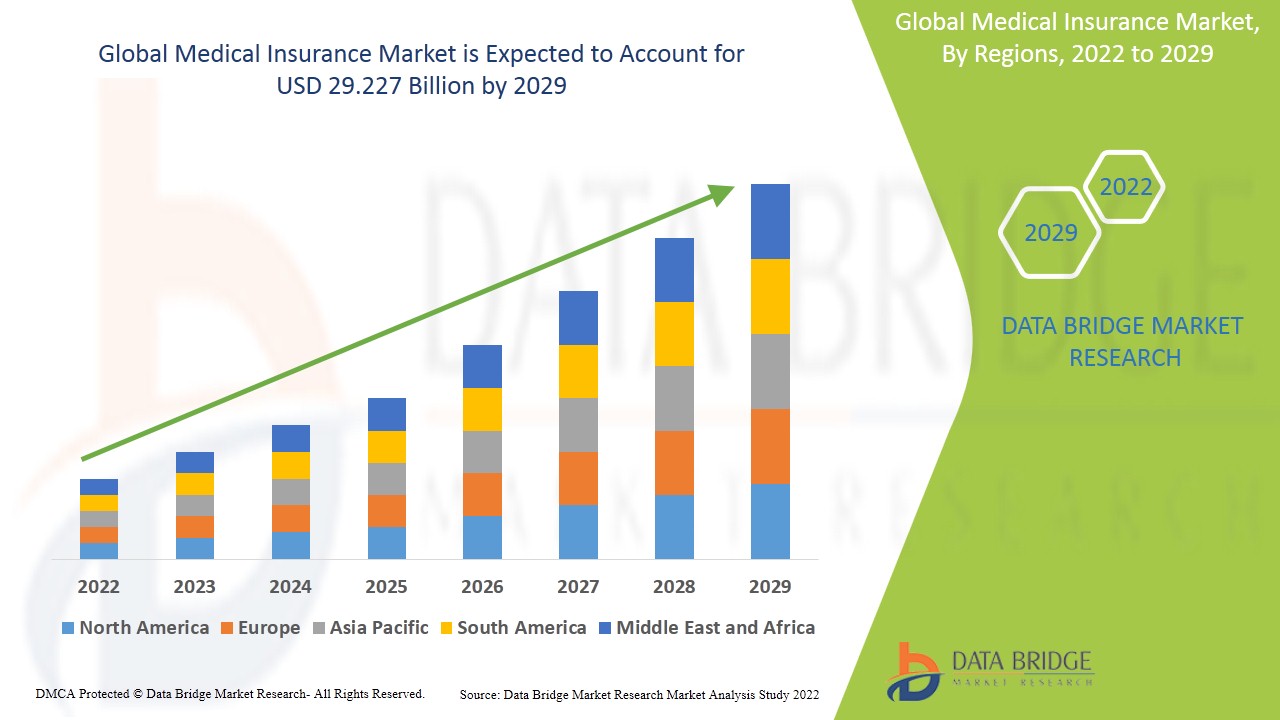

Data Bridge Market Research analyses that the medical insurance market to account USD 29.227 billion by 2029 growing at a CAGR of 10.30% in the forecast period of 2022-2029. The growing cost of healthcare and need for efficient flow of processes without the inconvenience caused due to payment processes will help in driving the growth of the health insurance market.

For the growth of business, Medical Insurance Market analysis report has a lot to offer and hence it plays a very important role in growth. Myriad of factors have been studied in this report that have an influence on the market and Medical Insurance Market industry. These factors can be listed as industry insight and critical success factors (CSFs), market segmentation, value chain analysis, industry dynamics, market drivers, market restraints, key opportunities, technology and application outlook, country-level and regional analysis, competitive landscape, company market share analysis and key company profiles. The analysis mentioned in the world class Medical Insurance Market report gives clear idea on various segments that are relied upon to view the quickest business development in the course of the estimate forecast frame.

Medical Insurance Marketing report is essentially helpful for mapping the strategies related to production, product launches, costing, inventory, purchasing and marketing. With the use of SWOT analysis and Porter’s Five Forces analysis which are two of the standard, prominent and full-proof methods, this market report is been framed. With this industry analysis report, it becomes easy to uncover the best market opportunities and foster resourceful information for the business to thrive in the market. The report offers appropriate solutions to the complex business challenges and works toward an effortless decision-making process. Transparent, reliable and extensive market information of the credible Medical Insurance Market business report will certainly develop business and improve return on investment (ROI).

Discover how the Medical Insurance Market is changing with key trends and forecasts. Access the report:

https://www.databridgemarketresearch.com/reports/global-medical-insurance-market

Comprehensive Overview of the Medical Insurance Market

Segments

- By Type: 0, 0, 0

- By Coverage: 0, 0, 0

- By End User: 0, 0, 0

- By Region: 0, 0, 0

The global medical insurance market can be segmented based on various factors. Firstly, by type, the market is divided into 0, 0, and 0 types of medical insurance plans. These types cater to different needs of individuals and offer varying levels of coverage and benefits. Secondly, based on coverage, the market is segmented into 0, 0, and 0 coverage options, each providing specific services and protection. Thirdly, by end-user, the market is categorized into 0, 0, and 0 end-user segments, reflecting the diverse range of consumers utilizing medical insurance. Lastly, the market is segmented by region, with key segments being 0, 0, and 0 regions, each contributing significantly to the global medical insurance market.

Market Players

- Company A

- Company B

- Company C

- Company D

- Company E

Several prominent players operate in the global medical insurance market, offering a wide range of products and services to consumers. Companies such as Company A, Company B, Company C, Company D, and Company E are among the top players in the market, each bringing unique offerings and competitive advantages. These market players engage in strategies such as mergers and acquisitions, partnerships, product innovations, and geographical expansions to strengthen their market presence and cater to the evolving needs of customers in the medical insurance sector.

The global medical insurance market is witnessing significant growth and evolution driven by various factors such as increasing healthcare costs, changing lifestyles, rising awareness about health and wellness, and expanding healthcare access in emerging markets. One of the key trends shaping the market is the growing adoption of digital technologies and mobile applications to streamline insurance processes, enhance customer experience, and provide real-time access to health services. Market players are increasingly investing in digitalization to improve operational efficiency, data analytics capabilities, and personalized service offerings, ultimately driving customer satisfaction and loyalty.

Moreover, the COVID-19 pandemic has accelerated the digitization of the medical insurance sector, with a growing emphasis on telemedicine services, remote consultations, and online claims processing. This shift towards virtual healthcare solutions has not only helped in maintaining continuity of care during the pandemic but also paved the way for a more tech-enabled and patient-centric healthcare ecosystem in the post-pandemic era. Market players are leveraging advanced technologies such as artificial intelligence, machine learning, blockchain, and IoT to develop innovative insurance products, customize coverage options, and enhance risk management practices.

In terms of market segmentation, a critical aspect to consider is the integration of value-based care models within medical insurance plans. Value-based care focuses on improving patient outcomes and reducing costs by emphasizing preventive care, care coordination, and patient engagement. Market players are aligning their insurance offerings with value-based care principles to drive better health outcomes, foster long-term patient relationships, and minimize healthcare expenditures. By incorporating value-based care into their product portfolios, insurers can differentiate themselves in a competitive market landscape and attract health-conscious consumers seeking comprehensive and proactive healthcare solutions.

Furthermore, the global medical insurance market is witnessing a shift towards consumer-driven healthcare, where individuals have greater control over their healthcare decisions, access to transparent pricing information, and opportunities to customize their insurance coverage based on specific needs and preferences. Market players are developing consumer-centric insurance products that offer flexibility, affordability, and extensive coverage options tailored to different demographics, including millennials, seniors, families, and small businesses. This customer-centric approach not only enhances customer satisfaction but also fosters brand loyalty and improves retention rates in an increasingly competitive market environment.

In conclusion, the global medical insurance market is undergoing a transformative period characterized by digital innovation, value-based care integration, consumer-driven approaches, and evolving regulatory landscapes. Market players need to adapt to these dynamic trends, capitalize on emerging opportunities, and continuously innovate to meet the evolving needs of consumers in a rapidly changing healthcare landscape. Leveraging technology, data analytics, and strategic partnerships will be crucial for market players to stay competitive, drive growth, and deliver sustainable value propositions in the global medical insurance market.The global medical insurance market is experiencing a paradigm shift driven by numerous factors, including technological advancements, changing consumer preferences, and evolving regulatory frameworks. One of the emerging trends in the market is the increasing adoption of personalized insurance products that cater to the individual needs of diverse consumer segments. Insurers are leveraging data analytics and AI algorithms to tailor coverage options, streamline claims processing, and offer customized recommendations to policyholders. This focus on personalization not only enhances customer satisfaction but also boosts customer retention and loyalty in a competitive market landscape.

Another key development in the medical insurance sector is the rise of value-based care models within insurance plans. Insurers are shifting towards outcome-based reimbursement models that incentivize healthcare providers to deliver high-quality, cost-effective care to patients. By aligning insurance offerings with value-based care principles, insurers can drive better health outcomes, reduce healthcare costs, and foster long-term relationships with healthcare providers and policyholders. This transition towards value-based care reflects a broader industry shift towards preventive care, chronic disease management, and holistic wellness programs that aim to improve population health and reduce healthcare expenditures in the long run.

Moreover, technological innovation is playing a pivotal role in reshaping the medical insurance market. Insurers are increasingly investing in digital technologies such as blockchain, IoT, and telemedicine to enhance operational efficiency, improve claims processing, and deliver remote healthcare services to policyholders. The integration of digital solutions not only accelerates the digitization of insurance processes but also empowers consumers to access healthcare services conveniently, securely, and cost-effectively. This trend is particularly relevant in the context of the COVID-19 pandemic, which has underscored the importance of virtual healthcare solutions and remote patient monitoring in ensuring continuity of care amidst global health crises.

Furthermore, the market players in the medical insurance industry are focusing on enhancing transparency, simplifying policy information, and providing greater financial protection to policyholders. Insurers are leveraging advanced data analytics tools to assess risk more accurately, price premiums fairly, and detect fraudulent claims proactively. By leveraging data-driven insights, insurers can optimize underwriting processes, improve risk management practices, and offer competitive pricing strategies that resonate with the evolving needs and preferences of modern consumers. This data-driven approach not only enables insurers to mitigate risks effectively but also empowers policyholders to make informed decisions about their insurance coverage and healthcare choices.

In conclusion, the global medical insurance market is undergoing a transformative phase characterized by digital innovation, value-based care integration, and data-driven decision-making. Market players need to stay abreast of these emerging trends, adapt their business strategies accordingly, and prioritize customer-centric solutions that address the evolving needs of policyholders. By embracing technological advancements, fostering industry collaboration, and embracing regulatory changes, insurers can position themselves for sustainable growth, competitive advantage, and long-term success in the dynamic landscape of the global medical insurance market.

Assess the business share occupied by the company

https://www.databridgemarketresearch.com/reports/global-medical-insurance-market/companies

Analyst-Focused Question Templates for Medical Insurance Market Evaluation

- What is the present size of the global Medical Insurance Market?

- How is the Medical Insurance Market expected to evolve in terms of growth rate?

- What are the important segmentations in this market?

- Who are the notable market players in this space?

- What are the recent major product innovations in this industry?

- Which countries have data representation in the report?

- Which region shows exponential growth potential?

- Which country is projected to dominate during the forecast period?

- Which global zone holds the largest portion of the market?

- Which country stands out with the fastest forecasted growth?

Browse More Reports:

Global Adrenocorticotropic Hormone (ACTH) Market

Global Adsorption Equipment Market

Global Advanced Structural Ceramics Market

Global Aerospace Accumulator Market

Global Aerospace Insulation Market

Global Age-Related Macular Degeneration (AMD) Disease - Anti VEGF Market

Global Agricultural Lubricants Market

Global Agriculture Compact Tractor Market

Global AI as a service (AIaaS) Market

Global Air Suspension Market

Global Aircraft Door Dampers Market

Global Aircraft Transparencies Market

Global Airport Access Control Market

Global Alcohol Prep Pads Market

Global Aliphatic Solvents and Thinners Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience, which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- [email protected]

- Books

- Software

- Courses

- Movies

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness