-

Новости

- ИССЛЕДОВАТЬ

-

Страницы

-

Группы

-

Статьи пользователей

-

Разработчики

In-vitro Colorectal Cancer Screening Tests Market Accelerates Toward 2034 with Innovations in Biomarker Detection, Digital Diagnostics, and Expanding Global Screening Programs – A Strategic Growth Outlook

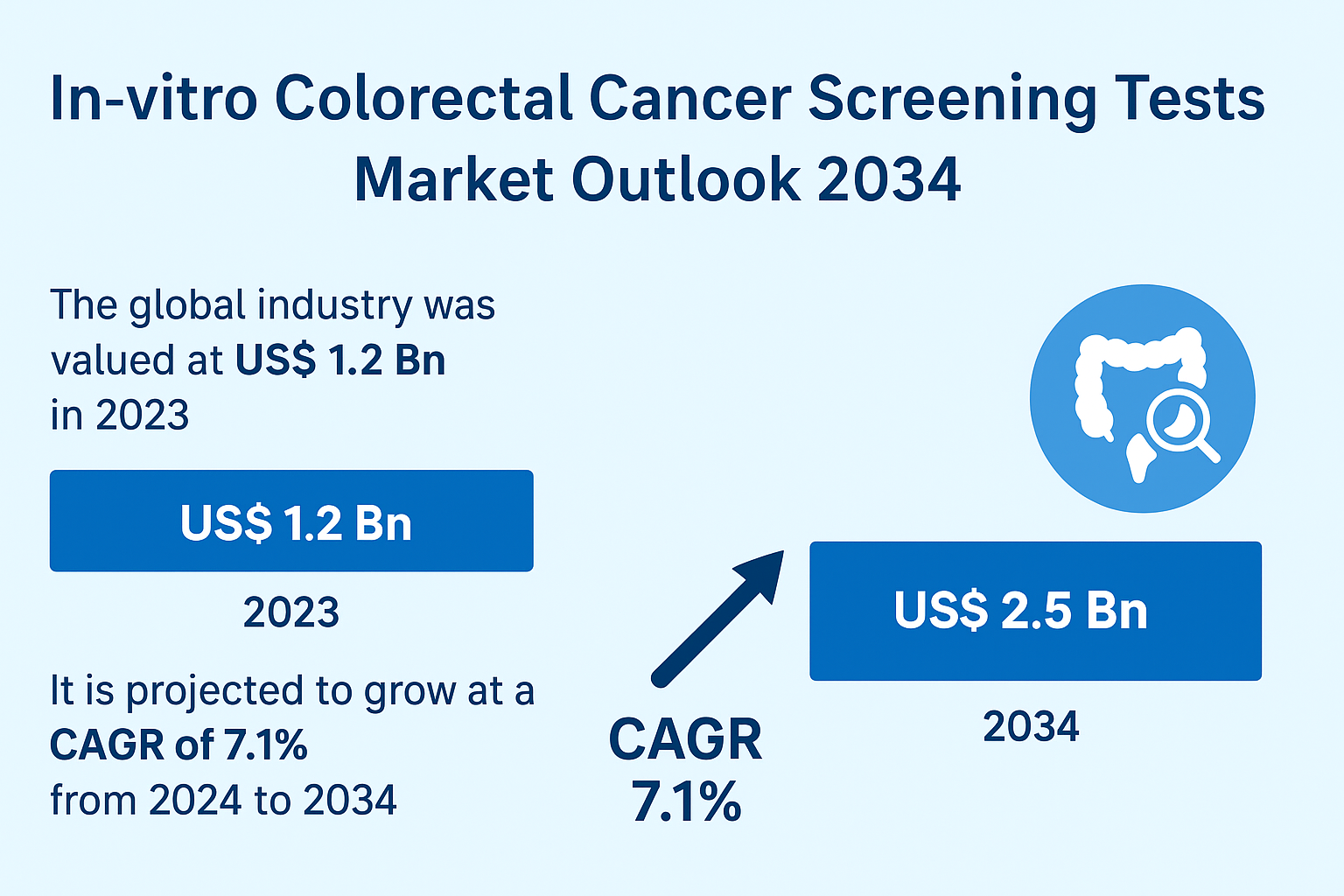

The global In-vitro Colorectal Cancer Screening Tests Market is witnessing rapid acceleration, marked by technological upgrades, wider adoption of population screening frameworks, and increasing emphasis on early-stage cancer detection. With a valuation of US$ 1.2 billion in 2023, the market is projected to grow significantly, reaching US$ 2.5 billion by 2034 at a CAGR of 7.1%.

Colorectal cancer (CRC) continues to represent one of the world’s most prevalent and deadly cancers, yet it is among the most preventable when detected early. In-vitro screening tests—especially non-invasive stool-based diagnostics and next-generation biomarker assays—are redefining how healthcare systems approach CRC prevention and surveillance.

This press release explores the competitive landscape, market dynamics, clinical relevance, technological breakthroughs, policy developments, and future prospects that define this evolving industry.

1. Market Overview: Why In-vitro Screening Is Becoming Indispensable

CRC accounts for approximately 10% of all cancer cases worldwide, making early intervention essential. Traditional diagnostics such as colonoscopy remain crucial, but their invasiveness, cost, and low compliance rates have pushed stakeholders to adopt more scalable, patient-friendly solutions.

In-vitro colorectal cancer screening tests—primarily Fecal Immunochemical Tests (FIT), Fecal DNA tests, and Guaiac Fecal Occult Blood Tests (gFOBT)—offer high accuracy at significantly lower costs, making them vital tools in reducing mortality and catching cancer early.

As awareness campaigns gain traction and global screening recommendations broaden, these tests will play a central role in preventive oncology.

2. Key Market Growth Factors

2.1 Increasing CRC Prevalence and Rising Adoption of Preventive Screening

Colorectal cancer prevalence continues to rise due to:

-

Sedentary lifestyles

-

High consumption of processed foods

-

Low fiber intake

-

Obesity

-

Smoking and alcohol use

The growing burden of CRC has accelerated the adoption of routine screening across countries, with many lowering screening eligibility to 45 years.

In-vitro tests are well-positioned to meet global demand due to:

-

Non-invasive methodology

-

Ease of home collection

-

Cost-effectiveness

-

High suitability for annual or biannual screening

2.2 FIT Segment Leads Global Market Share

The Fecal Immunochemical Test (FIT) segment holds the largest global share and is projected to maintain dominance throughout the forecast period.

Key strengths of FIT include:

-

Enhanced sensitivity to colorectal bleeding

-

Minimal dietary restrictions

-

Strong alignment with national screening programs

-

Easy usability and affordability

The test is widely favored in the U.S., Canada, Europe, Japan, South Korea, and Australia, where large-scale population screenings have been implemented.

2.3 Rising Popularity of DNA-Based Stool Testing

DNA-based stool tests are becoming a powerful complement to FIT. These tests detect mutations, methylation patterns, and other biomarkers shed from precancerous polyps or tumors.

The success of Cologuard has accelerated investments in:

-

Multi-target stool assays

-

RNA marker-based technologies

-

AI-powered molecular profiling

-

Next-generation sequencing (NGS)-based clinical diagnostics

DNA-based tests offer excellent sensitivity and are increasingly used for high-risk populations and patients needing enhanced diagnostic accuracy.

2.4 Hospitals & Clinics Strengthen Their Dominance

Hospitals & clinics remain the largest end-user segment due to:

-

Comprehensive diagnostic capability

-

Strong physician referrals

-

Structured patient follow-up workflows

-

Access to colonoscopy for confirmatory diagnosis

-

Integration of laboratory and pathology services

Despite growth in home-based test adoption, institutional settings still drive the bulk of test administration due to medical oversight and higher screening adherence.

3. Market Segmentation Highlights

By Test Type

-

Fecal Immunochemical Test (FIT)

-

Fecal DNA Test Kits

-

Guaiac Fecal Occult Blood Test (gFOBT) Kits

-

Others

By End-user

-

Hospitals & Clinics

-

Diagnostic Centers

-

Others

4. Regional Market Analysis

4.1 North America – Leading with Technological Adoption & High Screening Rates

North America continues to lead global CRC screening test adoption. The region benefits from:

-

Highly structured screening guidelines

-

Strong insurance coverage mechanisms

-

High awareness among adults

-

Availability of advanced stool DNA and blood-based screening options

The U.S. faces one of the highest CRC burdens globally, making early detection a national healthcare priority.

4.2 Europe – Strong Government-led Screening Programs

European nations maintain some of the highest CRC screening rates in the world. Government-organized FIT-based programs serve as the foundation of CRC prevention in:

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

Investment in molecular diagnostics and public health campaigns continues to propel market growth.

4.3 Asia Pacific – Fastest-growing Market Due to Large Populations and Rising Awareness

Key growth drivers include:

-

Increasing CRC incidence in China, India, and Southeast Asia

-

Growing government support for screening programs

-

Rapid expansion of healthcare infrastructure

-

Heightened awareness among middle-aged adults

Japan and South Korea already demonstrate high participation in FIT-based national screening programs, setting benchmarks for the region.

4.4 Latin America & MEA – Emerging Regions with Untapped Potential

Rising healthcare awareness, improving diagnostic availability, and growing government interest in preventive cancer care make these regions promising areas for future expansion.

5. Competitive Landscape Insight

The market is moderately fragmented, with leading players competing through technological innovation, strategic alliances, and expanded testing portfolios.

Major Companies Include:

-

Abbott Laboratories

-

Thermo Fisher Scientific Inc.

-

Eiken Chemical Co., Ltd

-

Qiagen

-

Quest Diagnostics Incorporated

-

Sentinel CH. SpA

-

Quidel Corporation

-

Freenome Holdings, Inc.

-

Immunostics, Inc.

-

BTNX, Inc.

These companies focus heavily on:

-

Advanced biomarker R&D

-

Strategic partnerships with hospitals and labs

-

Expansion of global screening coverage

-

Launch of next-generation fecal DNA and blood-based tests

6. Key Industry Developments Reshaping the Market

Guardant Health’s Shield™ Blood Test Expansion (2023)

The launch of Guardant Health’s Shield™ in partnership with Samsung Medical Centre (South Korea) represents a major milestone in CRC screening accessibility. Shield™ uses circulating tumor DNA to identify early cancer risk via a simple blood draw.

Geneoscopy and Labcorp Collaboration (2023)

Geneoscopy partnered with Labcorp to expand access to its advanced stool-based RNA test, enhancing its reach across diagnostic centers and care networks in the U.S.

7. Emerging Trends Likely to Reshape the Market Through 2034

7.1 Integration of Artificial Intelligence (AI)

AI-driven diagnostic platforms will unlock new possibilities by:

-

Improving biomarker interpretation

-

Enhancing test sensitivity

-

Predicting individualized screening intervals

-

Supporting clinical decision-making

7.2 Rise of Liquid Biopsy and Blood-based CRC Screening

Blood-based screening offers significant advantages for patients who prefer non-stool tests. These innovations are gaining traction in:

-

Primary care clinics

-

Remote populations

-

High-risk groups

Markers such as ctDNA, methylated DNA, and plasma proteins are being extensively researched.

7.3 Digital Health Ecosystems and Remote Testing

With rising demand for home screenings, digital platforms now support:

-

App-based sample instructions

-

Virtual assistance

-

Automated reminders

-

Digital delivery of test results

This digital shift is boosting test adherence and accessibility.

7.4 Growth of Multi-Marker and Multi-Analyte Tests

Future CRC diagnostics will integrate combinations of:

-

DNA mutations

-

RNA markers

-

Epigenetic signatures

-

Protein biomarkers

These multi-analyte approaches promise superior accuracy for earlier detection.

8. Opportunities and Challenges Ahead

Opportunities

-

Expansion of national CRC screening programs globally

-

Rising interest in home-based diagnostics

-

Breakthroughs in molecular biomarker discovery

-

Increased availability of reimbursement pathways

Challenges

-

Limited infrastructure in low-income regions

-

Low awareness and stigma around stool testing

-

Variability in test sensitivity across populations

-

Need for physician education on new biomarker technologies

Addressing these barriers will be essential to unlock full global market potential.

9. Strategic Outlook (2024–2034)

The next decade will redefine the landscape of colorectal cancer screening. With rising investment in genomic diagnostics, AI-powered tools, and multi-target assays, the market is transitioning toward:

-

Higher diagnostic precision

-

Broader accessibility

-

Greater patient participation

-

Digitally enabled workflows

With a projected valuation of US$ 2.5 billion by 2034, the In-vitro Colorectal Cancer Screening Tests Market is positioned to become one of the fastest-evolving segments of the preventive diagnostics industry.

- Books

- Software

- Courses

- Кинозал

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Игры

- Gardening

- Health

- Главная

- Literature

- Music

- Networking

- Другое

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness