-

Fil d’actualités

- EXPLORER

-

Pages

-

Groupes

-

Blogs

-

Développeurs

Medical Insurance Market Leaders: Growth, Share, Value, Size, and Scope By 2029

Competitive Analysis of Executive Summary Medical Insurance Market Size and Share

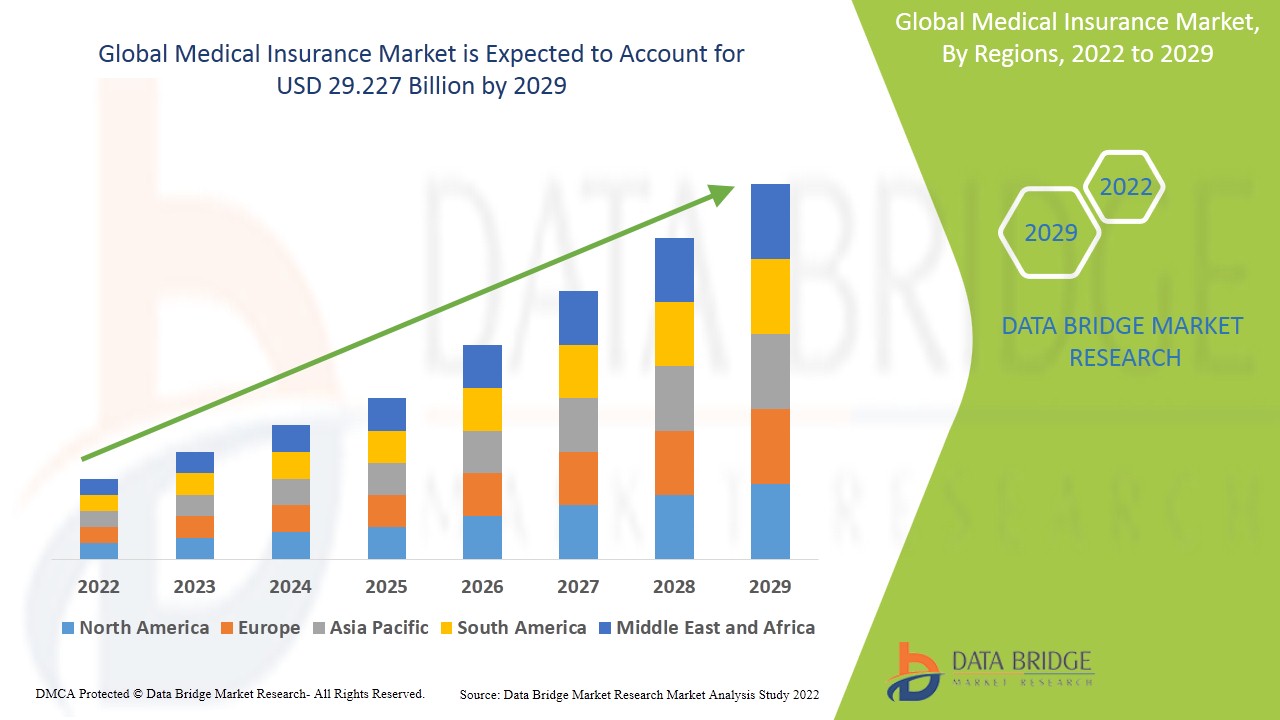

Data Bridge Market Research analyses that the medical insurance market to account USD 29.227 billion by 2029 growing at a CAGR of 10.30% in the forecast period of 2022-2029.

A competition that is getting higher day by day has kept many challenges in front of the businesses. A worldwide Medical Insurance Market research report is an exact source to gain valuable market insights and take better decisions about the important business strategies. This report has been framed after thoroughly understanding business environment which best suits the requirements of the client. Thus, market survey report is very essential in many ways to increase business and be successful. An excellent Medical Insurance Market report is a significant source of information about the industry, important facts and figures, expert opinions, and the newest developments across the globe.

The most brilliant Medical Insurance Market report proves to be an innovative and new solution for the businesses in today’s varying market place. Such global market research report is attaining high value in this era of globalization which opens the door of global market for the products. With the appropriate utilization of excellent practice models and brilliant method of research, this wonderful market report is generated which supports businesses to unearth the greatest opportunities to prosper in the market. Commitment, quality, devotion, and transparency are maintained throughout the high quality Medical Insurance Market business report to give the best output to the clients.

Get the edge in the Medical Insurance Market—growth insights and strategies available in the full report:

https://www.databridgemarketresearch.com/reports/global-medical-insurance-market

Medical Insurance Market Landscape Overview

Segments

- Based on type, the global medical insurance market can be segmented into health insurance, critical illness insurance, income protection insurance, and others. Health insurance is expected to dominate the market due to the increasing awareness about the importance of healthcare coverage among individuals and families worldwide. Critical illness insurance is also poised for growth as people seek financial protection against major health crises. Income protection insurance provides coverage for individuals who are unable to work due to illness or injury, ensuring they have a source of income during such challenging times.

- In terms of provider, the market can be classified into public health insurance providers and private health insurance providers. Public health insurance providers are typically government-run programs that offer coverage to eligible individuals based on certain criteria. Private health insurance providers, on the other hand, are companies that offer health insurance plans to individuals and organizations for a fee. The private health insurance segment is expected to witness significant growth due to the increasing demand for personalized and comprehensive health coverage options.

- On the basis of coverage, the global medical insurance market can be segmented into individual coverage and family coverage. Individual coverage caters to the health insurance needs of a single person, providing benefits and coverage as per the chosen insurance plan. Family coverage extends the coverage to include multiple family members under a single insurance policy, offering convenience and cost savings for families looking to secure healthcare coverage for all members.

- Geographically, the market can be segmented into North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. North America is expected to lead the market due to the presence of well-established healthcare infrastructure, high healthcare expenditures, and a large insured population. Europe is also a significant market owing to the widespread availability of advanced healthcare services and supportive government initiatives. Meanwhile, the Asia-Pacific region is anticipated to witness rapid growth driven by increasing healthcare awareness, rising disposable income, and expanding insurance coverage.

Market Players

- Some of the key players in the global medical insurance market include UnitedHealth Group, Anthem, Inc., Aetna Inc., Cigna, Allianz Care, AIA Group Limited, AXA, Berkshire Hathaway Inc., and Zurich Insurance Group. These market players engage in strategic initiatives such as mergers and acquisitions, partnerships, and product innovations to strengthen their market presence and enhance their service offerings. With a focus on expanding their customer base and improving operational efficiency, these players are poised to capitalize on the growing demand for medical insurance services worldwide.

The global medical insurance market is witnessing a significant shift towards more personalized and comprehensive health coverage options to meet the evolving needs of individuals and families worldwide. With the increasing awareness about the importance of healthcare coverage, there is a growing demand for different types of insurance plans such as health insurance, critical illness insurance, and income protection insurance. Health insurance remains a dominant segment in the market as more people recognize the value of having access to quality healthcare services without financial barriers. Critical illness insurance is gaining traction as individuals seek financial protection against unforeseen health crises, while income protection insurance provides a safety net for those unable to work due to illness or injury.

In terms of providers, both public and private health insurance providers play a crucial role in offering insurance coverage to individuals and organizations. Public health insurance providers, often government-run programs, cater to eligible individuals based on specific criteria, ensuring access to essential healthcare services. On the other hand, private health insurance providers offer a wide range of plans with more personalized options to meet the diverse needs of customers. The private health insurance segment is expected to witness considerable growth driven by the rising demand for tailored insurance solutions and enhanced coverage benefits.

The segmentation based on coverage type, including individual and family coverage, reflects the diverse preferences of consumers in securing healthcare protection. Individual coverage caters to the specific needs of a single person, providing a targeted approach to healthcare benefits and services. In contrast, family coverage extends the insurance umbrella to cover multiple family members under a single policy, offering a convenient and cost-effective solution for ensuring the health and well-being of all family members.

Geographically, different regions present unique opportunities and challenges for the global medical insurance market. North America remains a key market leader due to its well-established healthcare infrastructure, high healthcare spending, and a significant insured population. Europe also stands out as a prominent market with advanced healthcare services and supportive government initiatives promoting universal healthcare access. The Asia-Pacific region is poised for rapid growth, fueled by increasing healthcare awareness, rising disposable incomes, and expanding insurance penetration.

Key market players such as UnitedHealth Group, Anthem, Inc., Aetna Inc., and Cigna are actively engaging in strategic initiatives to strengthen their market position and expand their service offerings. Mergers and acquisitions, partnerships, and product innovations are key strategies employed by these players to enhance customer engagement, improve operational efficiency, and capture a larger share of the growing medical insurance market. By responding proactively to changing consumer needs and market dynamics, these players are well-positioned to capitalize on the increasing demand for medical insurance services on a global scale. The global medical insurance market is undergoing a transformative shift towards more personalized and comprehensive health coverage options to cater to the evolving needs of individuals and families globally. The increasing awareness regarding the significance of healthcare coverage is driving a surge in demand for various types of insurance plans, including health insurance, critical illness insurance, and income protection insurance. Health insurance continues to hold a dominant position in the market as the population recognizes the value of accessing quality healthcare services without financial constraints. Critical illness insurance is also gaining traction as individuals seek protection against unforeseen health crises, while income protection insurance offers a safety net for those unable to work due to health-related issues.

In the realm of providers, both public and private health insurance entities play pivotal roles in offering insurance coverage to individuals and organizations. Public health insurance providers, usually government-run programs, serve eligible individuals based on specific criteria, ensuring access to essential healthcare services. Conversely, private health insurance providers offer a diverse array of plans with tailored options to meet the varied needs of customers. The private health insurance segment is anticipated to experience substantial growth driven by the increasing demand for customized insurance solutions and enhanced coverage benefits.

Segmentation based on coverage types, such as individual and family coverage, mirrors the diverse preferences of consumers when securing healthcare protection. Individual coverage caters to the distinct needs of a single individual, providing a focused approach to healthcare benefits and services. In contrast, family coverage extends the insurance coverage to encompass multiple family members under a single policy, offering a convenient and cost-effective solution to ensure the health and well-being of all family members.

From a geographical standpoint, different regions present unique opportunities and challenges for the global medical insurance market. North America stands as a prominent market leader due to its well-established healthcare infrastructure, high healthcare expenditure, and a substantial insured population. Europe also emerges as a significant market with advanced healthcare services and supportive government initiatives promoting universal healthcare access. The Asia-Pacific region is poised for rapid growth, driven by escalating healthcare awareness, rising disposable incomes, and expanding insurance penetration.

Major market players like UnitedHealth Group, Anthem, Inc., Aetna Inc., and Cigna are proactively engaging in strategic initiatives to fortify their market positions, broaden their service offerings, and enhance customer engagement. Through mergers, acquisitions, partnerships, and product innovations, these key players aim to improve operational efficiency and capture a larger share of the expanding medical insurance market. By adapting to evolving consumer needs and market dynamics, these players are well-positioned to capitalize on the escalating demand for medical insurance services on a global scale.

Study the company’s hold in the market

https://www.databridgemarketresearch.com/reports/global-medical-insurance-market/companies

Custom Question Framework for Global Medical Insurance Market Reports

- What is the total revenue opportunity in the Medical Insurance Market?

- What is the mid-term growth rate projected?

- Which market segments are outperforming others?

- Who are the frontrunners in the competitive landscape?

- What key offerings have shaped market momentum recently?

- Which territories offer the best return on investment?

- What regions are witnessing sustained demand?

- What countries offer untapped potential?

- What global region has the most developed ecosystem?

- What role does innovation play in shaping this Medical Insurance Market?

Browse More Reports:

Global Secondary Macronutrients Market

Global Security System at Workplace Market

Global Seed Protection Market

Global Self-fusing Silicone Tape Market

Global Self-Storage and Moving Services Market

Global Semi-Autonomous Vehicle Market

Global Sentiments Analytics Market

Global Service Lifescale Management Market

Global Set-Top Boxes Market

Global Shiitake Mushroom Market

Global Shipping Container Liner Market

Global Shotcrete/Sprayed Concrete Market

Global Shower Enclosure and Cubicles Market

Global Shrink Drum Liner Market

Global Signaling Devices Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- [email protected]

- Books

- Software

- Courses

- Film

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jeux

- Gardening

- Health

- Domicile

- Literature

- Music

- Networking

- Autre

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness