-

Feed de Notícias

- EXPLORAR

-

Páginas

-

Grupos

-

Blogs

-

Developers

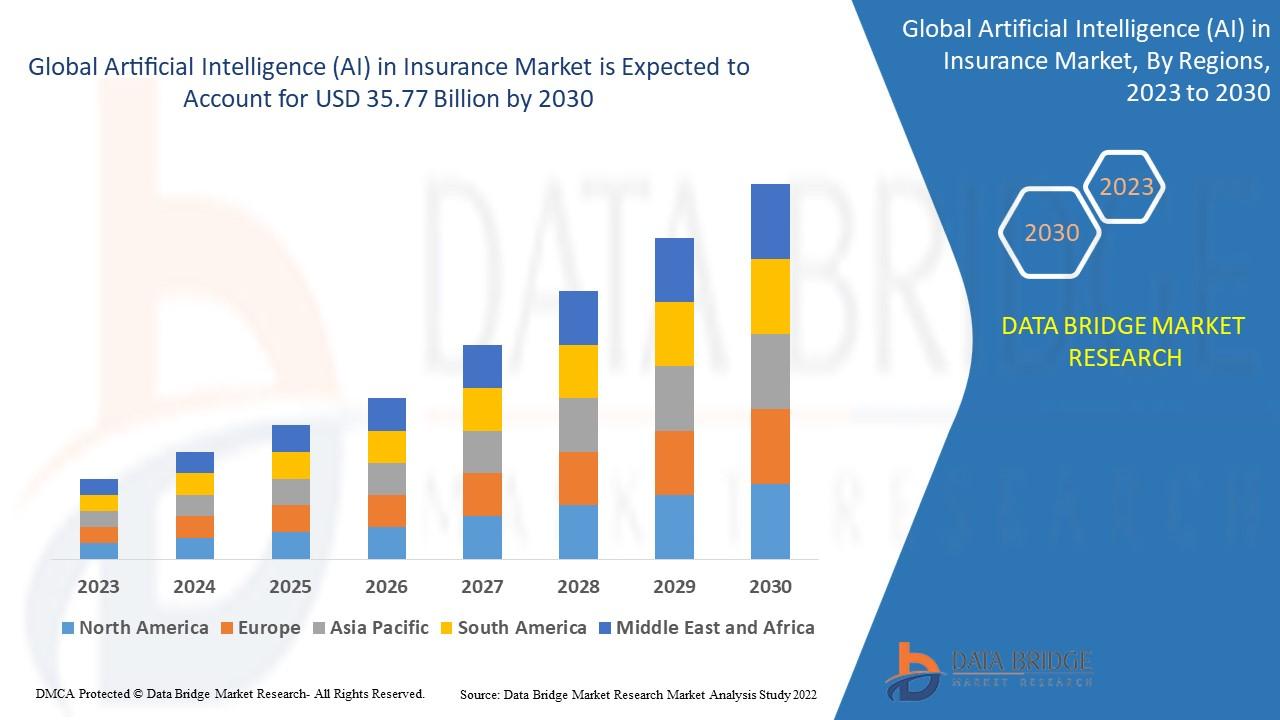

AI in Insurance Market Poised for Transformation as Insurers Embrace Advanced Automation and Analytics

"Executive Summary Artificial Intelligence (AI) in Insurance Market Value, Size, Share and Projections

CAGR Value

During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 33.06%, primarily driven by advancements in predictive analytics

The world class Artificial Intelligence (AI) in Insurance Market research report is a critical aspect in planning business objectives or goals. It is an organized technique to bring together and document information about the Artificial Intelligence (AI) in Insurance Market industry, market, or potential customers. This report is generated by taking into account several steps which can be summed up as; title page creation, attaching a table of contents, editing it in the executive summary, writing introduction, writing the qualitative research and survey research segment, summarizing the types of data used in drawing conclusions, distribute findings based on research and then concluding with call to action by the reader.

The data included in the finest Artificial Intelligence (AI) in Insurance Market business report not only lends a hand to plan the investment, advertising, promotion, marketing and sales strategy more valuably but also aids in taking sound and efficient decisions. This data is useful for businesses in characterizing their individual strategies. The competitive analysis conducted in this report covers strategic profiling of key market players, their core competencies, and competitive landscape. Examination of major challenges faced currently by the business and the probable future challenges that the business may have to face while operating in this market are also considered. The universal Artificial Intelligence (AI) in Insurance Marketing report is provided with the transparent research studies which have taken place by a team work of experts in their own domain.

Plan smarter with expert insights from our extensive Artificial Intelligence (AI) in Insurance Market research. Download now:

https://www.databridgemarketresearch.com/reports/global-artificial-intelligence-ai-in-insurance-market

Artificial Intelligence (AI) in Insurance Business Landscape Review

Segments

- By Component:

The AI in insurance market can be segmented by component into solutions and services. Solutions segment is further divided into software tools and platforms. The services segment includes consulting services, integration services, and maintenance & support services. The rising need for advanced solutions to streamline insurance operations, enhance customer experience, and improve risk assessment is driving the growth of the solutions segment in the AI in insurance market.

- By Technology:

On the basis of technology, the market is segmented into machine learning, natural language processing, computer vision, and others. Machine learning technology is extensively used in the insurance sector for tasks such as underwriting, fraud detection, and claims processing. Natural language processing technology is gaining traction for chatbots and virtual assistants in insurance customer service, while computer vision technology is being employed for image analysis and visual data processing.

- By Application:

In terms of application, the AI in insurance market is categorized into claims management, customer chatbots, policy personalization, risk assessment, and others. Claims management is a key application area where AI technologies are being utilized to automate claims processing, reduce fraud, and improve efficiency. Customer chatbots are being deployed to provide 24/7 customer support and enhance customer engagement.

Market Players

- IBM Corporation:

IBM offers a range of AI solutions for the insurance industry, including IBM Watson AI technology that enables insurers to leverage data for better decision-making, personalized customer experiences, and improved operational efficiency.

- Microsoft Corporation:

Microsoft provides AI tools and services, such as Azure AI, that can be tailored to meet the specific needs of insurance companies. These solutions help insurers automate processes, analyze data effectively, and enhance customer interactions.

- Amazon Web Services, Inc.:

Amazon Web Services offers AI and machine learning services that enable insurance providers to build scalable and cost-effective AI solutions. These services help insurers improve risk assessment, optimize claims processing, and enhance customer service.

- Google LLC:

Google's AI and machine learning capabilities are being utilized by insurance companies to enhance fraud detection, customer segmentation, and predictive analytics. Google Cloud AI solutions empower insurers to drive innovation and competitiveness in the market.

The global artificial intelligence (AI) in insurance market is highly competitive, with key players focusing on strategic partnerships, product innovation, and mergers and acquisitions to gain a competitive edge in the market. The increasing adoption of AI technologies in the insurance sector, driven by the need for operational efficiency, personalized customer experiences, and advanced risk assessment, is expected to fuel market growth in the forecast period.

The AI in insurance market is witnessing a significant transformation due to the integration of advanced technologies to streamline operations and enhance customer service. One notable trend in the market is the increasing focus on personalized customer experiences and tailored insurance solutions. Insurers are leveraging AI technologies such as machine learning, natural language processing, and computer vision to automate processes, improve risk assessment, and provide innovative services to customers. The application of AI in claims management, customer chatbots, policy personalization, and risk assessment is reshaping the traditional insurance landscape and driving companies to adopt cutting-edge solutions to stay competitive in the market.

Market players such as IBM Corporation, Microsoft Corporation, Amazon Web Services, Inc., and Google LLC are at the forefront of AI innovation in the insurance sector. These companies offer a diverse range of AI solutions and services that enable insurers to leverage data, automate processes, and enhance customer interactions. IBM's Watson AI technology, Microsoft's Azure AI tools, Amazon Web Services' AI and machine learning services, and Google's Cloud AI solutions are empowering insurance providers to meet the evolving needs of the industry and deliver value-added services to customers.

The competitive landscape of the global AI in insurance market is characterized by strategic partnerships, product innovation, and mergers and acquisitions among key players. Companies are focusing on expanding their AI capabilities, enhancing solution offerings, and adapting to digital transformation trends to gain a competitive edge in the market. The increasing adoption of AI technologies in the insurance sector is driven by the demand for operational efficiency, personalized customer experiences, and advanced risk assessment capabilities. As insurers continue to invest in AI solutions to improve processes, reduce costs, and drive innovation, the market is expected to witness significant growth in the coming years.

In conclusion, the AI in insurance market is poised for rapid expansion as technology continues to reshape the insurance industry. With the increasing emphasis on personalized services, efficient operations, and enhanced customer experiences, AI solutions are becoming indispensable for insurers looking to thrive in a competitive marketplace. As market players innovate and collaborate to meet the evolving needs of the industry, the AI in insurance market is expected to present new opportunities for growth and innovation in the future.The AI in insurance market is experiencing a significant shift towards leveraging advanced technologies to streamline operations and enhance customer service. One prominent trend driving this transformation is the increasing emphasis on personalized customer experiences and tailored insurance solutions. Insurers are turning to AI technologies like machine learning, natural language processing, and computer vision to automate processes, enhance risk assessment, and deliver innovative services to their customers. The application of AI in key areas such as claims management, customer chatbots, policy personalization, and risk assessment is revolutionizing the traditional insurance landscape, prompting companies to embrace cutting-edge solutions to maintain competitiveness.

Major players in the AI in insurance market, including IBM Corporation, Microsoft Corporation, Amazon Web Services, Inc., and Google LLC, are leading the charge in AI innovation within the insurance sector. These companies offer a diverse range of AI solutions and services that empower insurers to harness data effectively, automate operations, and elevate customer interactions. IBM's Watson AI technology, Microsoft's Azure AI tools, Amazon Web Services' AI and machine learning services, and Google's Cloud AI solutions are equipping insurance providers to meet the evolving demands of the industry and deliver value-added services to their clientele.

The competitive landscape of the global AI in insurance market is characterized by strategic partnerships, continuous product innovation, and mergers and acquisitions among industry leaders. Companies are strategically expanding their AI capabilities, enhancing their solution portfolios, and aligning with digital transformation trends to establish a competitive edge in the market. The growing adoption of AI technologies in the insurance sector is primarily fueled by the quest for operational efficiency, personalized customer experiences, and advanced risk assessment capabilities. As insurers persist in investing in AI solutions to optimize processes, cut costs, and foster innovation, the market is poised to witness substantial growth in the foreseeable future.

In summary, the AI in insurance market is on the brink of rapid expansion as technological advancements reshape the insurance landscape. With a growing focus on providing personalized services, driving operational efficiency, and enhancing customer experiences, AI solutions are becoming indispensable for insurers seeking to thrive in a fiercely competitive environment. Through innovation and collaboration, market players are poised to address the evolving needs of the industry, thereby unlocking fresh opportunities for growth and innovation in the forthcoming years.

Dive into the company’s market size contribution

https://www.databridgemarketresearch.com/reports/global-artificial-intelligence-ai-in-insurance-market/companies

Artificial Intelligence (AI) in Insurance Market Intelligence: Key Analytical Question Sets

- How big is the Artificial Intelligence (AI) in Insurance Market industry in current figures?

- What is the projected Artificial Intelligence (AI) in Insurance Market evolution scenario?

- What are the key Artificial Intelligence (AI) in Insurance Market breakdowns shown in the report?

- Who are the major players with global Artificial Intelligence (AI) in Insurance Market reach?

- Which countries show exceptional performance in the Artificial Intelligence (AI) in Insurance Market?

- What key brands dominate the landscape for Artificial Intelligence (AI) in Insurance Market?

Browse More Reports:

Global Brain Ischemia Market

Global Breast Cancer 1 (BRCA1) and Breast Cancer 2 (BRCA2) Genes Market

Global Bromhidrosis Disease Treatment Market

Global Building and Construction Tapes Market

Global Building Thermal Insulation Materials Market

Global Bunk Trailers Market

Global Buschke–Ollendorff Syndrome Market

Global Business Intelligence (BI) Vendors Market

Global C and X Band Radar Transmitter Market

Global Canned Beans Market

Global Canned Mushroom Market

Global Capacitive Ceramic Pressure Sensor Market

Global Capsule Coffee Machine Market

Global Caravanning Market

Global Carbon-negative Plastics Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- [email protected]

"

- Books

- Software

- Courses

- Movies

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jogos

- Gardening

- Health

- Início

- Literature

- Music

- Networking

- Outro

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness