-

Feed de notícias

- EXPLORAR

-

Páginas

-

Grupos

-

Blogs

-

Developers

Sludge Dewatering Equipment Market Outlook 2035: Driving Sustainable Wastewater Management and Resource Recovery

The global focus on sustainable waste management, water conservation, and clean energy is fueling rapid advancements in the sludge dewatering equipment industry. As urbanization intensifies and industrial activities expand, the volume of wastewater and sludge generation continues to rise worldwide. Sludge treatment is a critical component of municipal and industrial wastewater treatment processes, and dewatering equipment plays a vital role in reducing sludge volume, cutting transportation costs, and facilitating energy recovery.

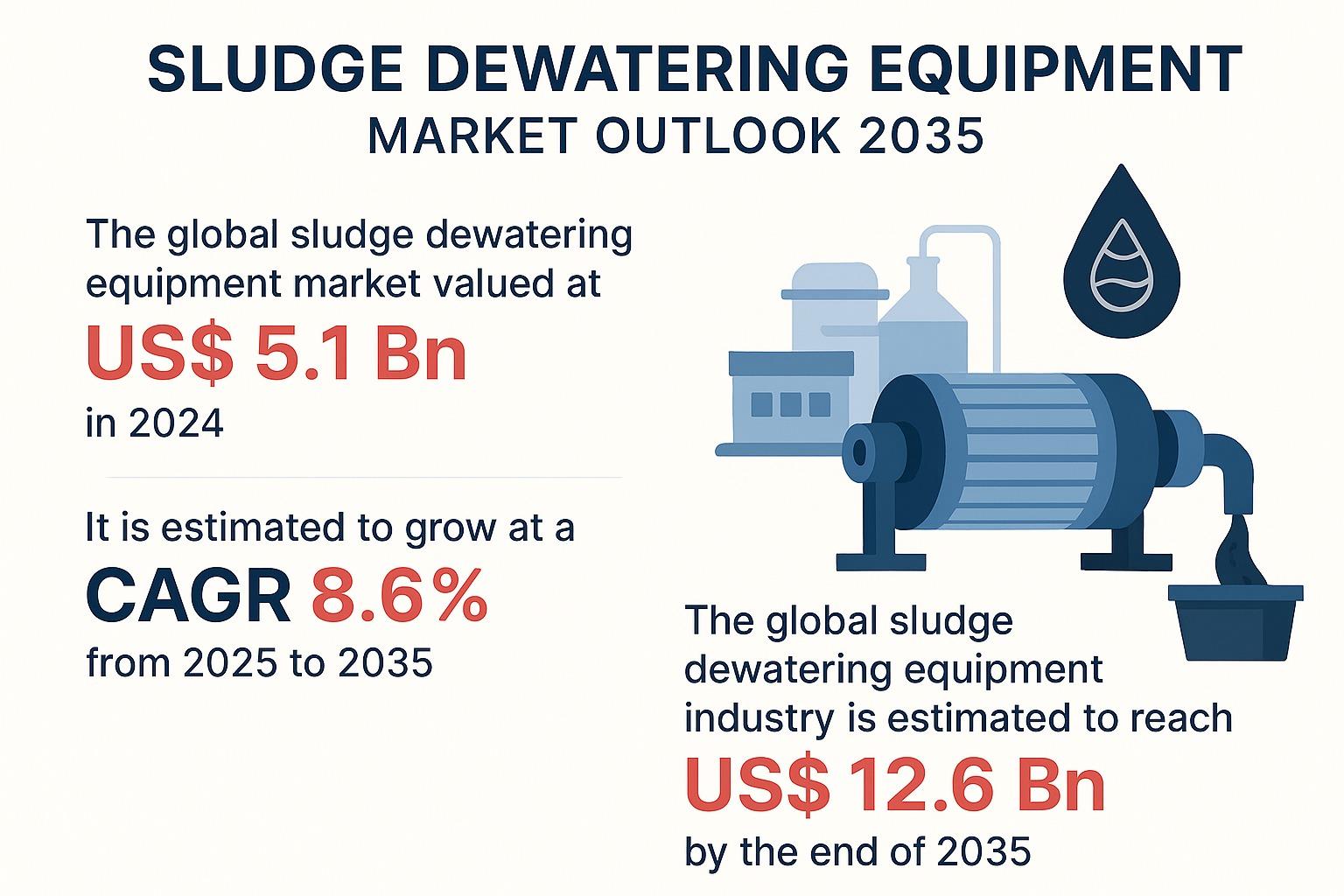

In 2024, the global sludge dewatering equipment market was valued at US$ 5.1 billion. Propelled by stringent environmental regulations and technological advancements, the market is projected to grow at a CAGR of 8.6% between 2025 and 2035, reaching US$ 12.6 billion by 2035.

Analysts' Viewpoint: Innovation and Sustainability at the Core

According to industry analysts, growth in the sludge dewatering equipment market is primarily driven by rapid urbanization, industrial expansion, and tightening environmental regulations. Governments and municipalities are enforcing stricter norms for sludge disposal to minimize ecological damage and promote cleaner wastewater treatment. Additionally, the demand for energy recovery, biosolids reuse, and reduced operational costs is pushing industries to adopt modern, energy-efficient dewatering technologies.

Manufacturers are focusing on developing advanced solutions such as centrifuges, screw presses, electro-dewatering systems, and membrane-based dewatering technologies. These innovations help increase sludge dryness, reduce operational expenditure (OPEX), and improve lifecycle efficiency.

Market Overview: What is Sludge Dewatering?

Sludge dewatering is the process of removing water content from sludge generated during wastewater treatment. The resulting semi-solid output, known as “cake”, is easier to handle, transport, recycle, or dispose of. Equipment such as belt filter presses, centrifuges, plate filter presses, screw presses, and screw dehydrators are widely used in both municipal and industrial facilities.

Dewatered sludge can be:

- Used for energy recovery in processes like anaerobic digestion.

- Converted to biosolids for agricultural application.

- Safely transported to landfills, with lower logistics cost due to reduced volume and weight.

Key Market Drivers

1. Regulatory Compliance and Sustainability Mandates

Governments across North America, Europe, and Asia-Pacific are enforcing strict rules to minimize sludge dumping, protect groundwater, and reduce greenhouse gas emissions. The European Union’s Sewage Sludge Directive, alongside similar laws in the U.S. and Asia, mandates proper treatment of sludge to reduce toxins, pathogens, and water content before disposal or reuse.

Emerging economies are aligning with global sustainability standards, creating new opportunities for advanced sludge treatment equipment. Moreover, sludge is increasingly viewed as a resource rather than waste, integral to the circular economy—supporting biosolids production, energy generation, and fertilizer manufacturing.

2. Technological Innovation and Efficiency Upgrades

The sludge dewatering industry is evolving from traditional systems to advanced, energy-saving equipment. Industry players are investing in solutions that reduce cost, improve sludge dryness, minimize polymer consumption, and offer automation.

Popular innovations include:

- Decanter centrifuges: High-speed and efficient for large-scale operations.

- Screw presses: Low-energy, low-maintenance systems ideal for municipal use.

- Electro-dewatering systems: Use electric fields to extract additional water, enhancing sludge dryness.

- Smart automation systems: Optimize polymer dosing, energy usage, and monitor real-time operations.

Compact, modular systems are also gaining traction in smaller municipalities and industries, especially in Asia-Pacific.

Equipment Outlook: Belt Filter Press Leads the Market

Despite the rise of advanced technologies, belt filter presses remain one of the most widely used equipment types due to:

- Low capital and operating costs

- Simple operation and maintenance requirements

- Continuous processing capabilities

- Suitability for municipal wastewater plants

However, equipment such as screw presses and centrifuges are becoming popular in large-scale industrial plants due to higher efficiency and better sludge dryness.

Regional Insights

Asia Pacific: Market Leader with 34% Share

The Asia Pacific (APAC) region dominates the global sludge dewatering equipment market, accounting for approximately 34% of global revenue. This growth is driven by:

- Rapid industrialization and population growth

- Rising municipal wastewater generation

- Large-scale infrastructure development for water treatment

- Government investments in smart city and sanitation projects

Countries like China, India, Japan, and ASEAN nations are leading contributors to APAC’s dominance.

Europe: Strong Regulations and Mature Infrastructure

Europe is the second-largest market, backed by well-established wastewater treatment infrastructure and environmentally conscious policies. The circular economy model and regulations like the EU Sewage Sludge Directive are pushing industries and municipalities to adopt advanced, sustainable dewatering technologies.

North America: Steady Growth with Focus on Innovation

North America shows steady growth, driven by modernization of aging wastewater systems, increased industrial water treatment, and adoption of energy-efficient and automated dewatering systems.

Competitive Landscape

Several global players dominate the sludge dewatering market through technological leadership, strong distribution networks, and turnkey solutions. Key manufacturers include:

- Alfa Laval

- ANDRITZ

- Veolia

- HUBER SE

- Flottweg SE

- GEA Group

These companies are investing in R&D to develop innovative solutions like electro-dewatering, AI-based automation, and membrane technologies. Service-based business models, including long-term maintenance contracts and lifecycle optimization, are becoming popular among OEMs.

Recent Market Developments

- 2023–2024: Alfa Laval introduced its ALDEC G3 decanter centrifuges with improved energy efficiency and higher cake dryness, promoting lower OPEX and sustainability.

- 2024: HUBER SE commissioned major belt dryer installations capable of producing over 90% dry solids, integrated with heat recovery and advanced monitoring.

- Veolia and ANDRITZ are focusing on smart dewatering solutions and global partnerships, especially in the Asia-Pacific region.

Future Outlook: What Lies Ahead by 2035?

The future of the sludge dewatering equipment market looks promising with growth driven by:

- Mandatory sludge management regulations

- Rising wastewater volumes from urban and industrial sectors

- Technological advancements in electro-dewatering and automation

- Increased emphasis on energy recovery and biosolids reuse

By 2035, sludge dewatering will not just be a wastewater treatment necessity—it will be central to waste-to-energy systems, agricultural sustainability, and circular economy strategies.

Conclusion

As the world grapples with resource scarcity, environmental concerns, and urban population growth, sludge dewatering equipment has emerged as a cornerstone of sustainable water and waste management. With a projected market value of US$ 12.6 billion by 2035, this industry is set to transform sludge from a liability into a valuable resource.

- Books

- Software

- Courses

- Filmes

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jogos

- Gardening

- Health

- Início

- Literature

- Music

- Networking

- Outro

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness