-

Fil d’actualités

- EXPLORER

-

Pages

-

Groupes

-

Blogs

-

Développeurs

Customization and Gifting Trends Supporting Growth in the Mug Market

Introduction

The mug market is a vibrant segment of the global consumer goods industry. Mugs are essential items in everyday life, used for coffee, tea, hot chocolate, and other beverages. Their importance goes beyond functionality. Today, mugs are also symbols of personal style, gifting culture, and branding. From ceramic and glass to stainless steel and eco-friendly materials, the variety available makes the market diverse and dynamic.

In recent years, the mug market has experienced steady growth. Rising coffee and tea consumption worldwide has significantly boosted demand. At the same time, changing consumer preferences for sustainable and personalized products have added new dimensions to the industry. As mugs are often linked with lifestyle trends and corporate promotions, their role in the global economy is expanding.

Stay ahead with crucial trends and expert analysis in the latest XYZ report. Download now: https://www.databridgemarketresearch.com/reports/global-mug-market

Market Overview

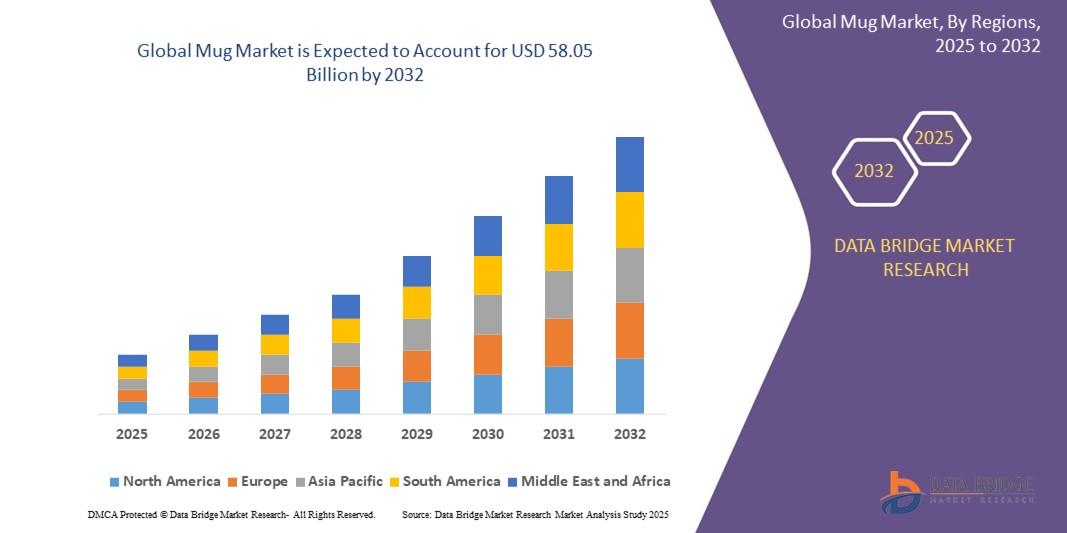

The global mug market has grown consistently over the last decade. The increase in café culture, workplace beverage habits, and at-home consumption of hot drinks has driven demand. Historically, ceramic mugs have dominated the market due to their durability and affordability. However, the trend is shifting toward stainless steel travel mugs, insulated variants, and eco-friendly designs.

North America and Europe are currently the largest markets. These regions benefit from high coffee consumption and strong demand for branded merchandise. Meanwhile, Asia-Pacific is emerging as a growth hotspot. Countries like China, India, and Japan are experiencing rapid adoption due to cultural beverage consumption and rising disposable incomes.

Looking ahead, the global mug market is expected to expand further. A combination of lifestyle changes, product innovation, and e-commerce penetration will continue to fuel market growth across developed and developing economies.

Key Market Drivers

Several factors are fueling the expansion of the mug market:

-

Rising Coffee and Tea Consumption

Coffee culture has grown rapidly in urban areas worldwide, while tea remains a staple in many regions. This directly increases demand for both household mugs and takeaway options. -

Corporate Branding and Gifting

Customized mugs are widely used for corporate promotions and brand visibility. This segment plays a key role in boosting sales, especially in the business-to-business (B2B) market. -

E-commerce Growth

Online platforms have significantly widened access to different mug designs. Consumers now enjoy a broad range of choices, from designer mugs to eco-friendly travel mugs, delivered directly to their homes. -

Sustainability Trends

Growing awareness of environmental issues is encouraging the adoption of reusable mugs. Brands are launching eco-friendly variants made from bamboo, recycled plastic, and stainless steel to reduce single-use waste. -

Lifestyle and Gifting Trends

Personalized and novelty mugs are increasingly popular as gifts. This trend enhances seasonal demand during holidays and special occasions.

Market Segmentation

The mug market can be divided into several segments:

-

By Material

-

Ceramic: Affordable, versatile, and still the most widely used.

-

Glass: Preferred for aesthetic appeal and premium consumption.

-

Stainless Steel: Popular for travel and insulation properties.

-

Plastic and Bamboo: Lightweight and eco-friendly options gaining traction.

-

-

By Product Type

-

Standard mugs: Common for home and office use.

-

Travel mugs: Designed with insulation for on-the-go consumption.

-

Specialty mugs: Personalized, novelty, or themed designs.

-

-

By End User

-

Household: Dominates the market due to daily consumption needs.

-

Commercial: Includes cafes, restaurants, and hotels.

-

Corporate: Used for promotions, branding, and gifting.

-

-

By Region

-

North America: Leading market due to high coffee consumption.

-

Europe: Strong demand for premium and designer mugs.

-

Asia-Pacific: Fastest-growing region driven by urbanization and increasing disposable income.

-

Latin America & Middle East and Africa: Growing markets with rising café culture.

-

Among these segments, stainless steel travel mugs and eco-friendly materials are growing the fastest. The shift toward sustainability and mobility is shaping consumer choices.

Competitive Landscape

The mug market is highly competitive, with both global and regional players contributing to growth. Key companies are focusing on design innovation, eco-friendly solutions, and branding partnerships. Leading players include:

-

Tervis Tumbler – Known for insulated and customizable mugs.

-

Thermos LLC – A pioneer in insulated travel mugs.

-

IKEA – Offers affordable and diverse designs for mass consumers.

-

Starbucks Corporation – Popular for branded mugs and seasonal collections.

-

Contigo – Specializes in spill-proof travel mugs.

Strategies such as new product launches, collaborations with lifestyle brands, and the use of sustainable materials are common among major players. Local artisans and small businesses also contribute significantly with handcrafted and personalized mug offerings.

Challenges and Restraints

Despite steady growth, the mug market faces certain challenges:

-

High Competition: Intense rivalry makes it difficult for new entrants to establish themselves.

-

Price Sensitivity: In some markets, consumers prefer low-cost options, limiting demand for premium mugs.

-

Supply Chain Issues: Disruptions in raw material supply or rising costs of ceramics and metals can affect production.

-

Environmental Concerns: While eco-friendly mugs are gaining popularity, the manufacturing process of ceramics and plastics still poses sustainability issues.

Future Outlook

The mug market is expected to continue its positive trajectory in the coming years. The increasing popularity of reusable mugs will drive growth, particularly as governments and organizations push for eco-friendly consumption. Personalization, gifting, and branding will further expand demand across both individual and corporate customers.

Technological advancements, such as temperature-controlled smart mugs, are also expected to gain traction. With consumers seeking convenience and sustainability, innovative products will likely dominate future growth.

Asia-Pacific is expected to remain the fastest-growing region, while North America and Europe will retain strong market positions. Emerging economies will see higher adoption rates as café culture expands and consumer lifestyles evolve.

Conclusion

The mug market is more than just a utility-driven industry. It is a dynamic blend of lifestyle, sustainability, and branding. Rising coffee and tea consumption, coupled with growing interest in personalized and eco-friendly mugs, is shaping the future of the market. Although challenges such as price sensitivity and competition exist, opportunities in sustainable product design and technological innovation are vast.

As global consumer behavior continues to evolve, the mug market is set to play an even more important role in everyday life and global commerce.

Frequently Asked Questions (FAQs)

1. What is the growth rate of the mug market?

The mug market is expected to grow steadily in the coming years, supported by rising beverage consumption and sustainability trends.

2. Which region is expected to dominate the mug market in the future?

Asia-Pacific is projected to be the fastest-growing region, while North America and Europe will continue to lead in overall demand.

3. Who are the leading players in the mug market?

Major players include Tervis Tumbler, Thermos LLC, IKEA, Starbucks, and Contigo.

4. What are the major challenges faced by the mug market?

Challenges include high competition, price sensitivity, supply chain disruptions, and environmental concerns in production.

5. What are the future opportunities in the mug market?

Future opportunities lie in eco-friendly designs, personalization, gifting trends, and smart mug technologies.

6. Why are eco-friendly mugs gaining popularity?

Consumers are increasingly concerned about sustainability, which is boosting demand for bamboo, stainless steel, and reusable mugs.

7. How does e-commerce impact the mug market?

E-commerce platforms have expanded product reach, offering consumers a wide variety of mugs and fueling overall market growth.

Browse More Reports:

Asia-Pacific Cold Sore Treatment Market

Middle East and Africa Cold Sore Treatment Market

North America Colorants Market

Europe Colorants Market

Asia-Pacific Colorants Market

Middle East and Africa Colorants Market

Europe Colorectal Surgical Devices Market

North America Colorectal Surgical Devices Market

Middle East and Africa Colorectal Surgical Devices Market

Asia-Pacific Colorectal Surgical Devices Market

North America Container Security Market

Egypt Cyber Security Market

Europe Dental Instruments Market

North America Dental Instruments Market

Asia-Pacific Dental Instruments Market

Middle East and Africa Dental Instruments Market

North America Diagnostic Imaging Equipment Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- [email protected]

- Books

- Software

- Courses

- Film

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jeux

- Gardening

- Health

- Domicile

- Literature

- Music

- Networking

- Autre

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness