-

Newsfeed

- ERKUNDEN

-

Seiten

-

Gruppen

-

Blogs

-

Entwickler

How Taxation Legal Services Market is Guiding Businesses Through Complex Global Regulations

"Executive Summary Taxation Legal Services Market: Growth Trends and Share Breakdown

CAGR Value

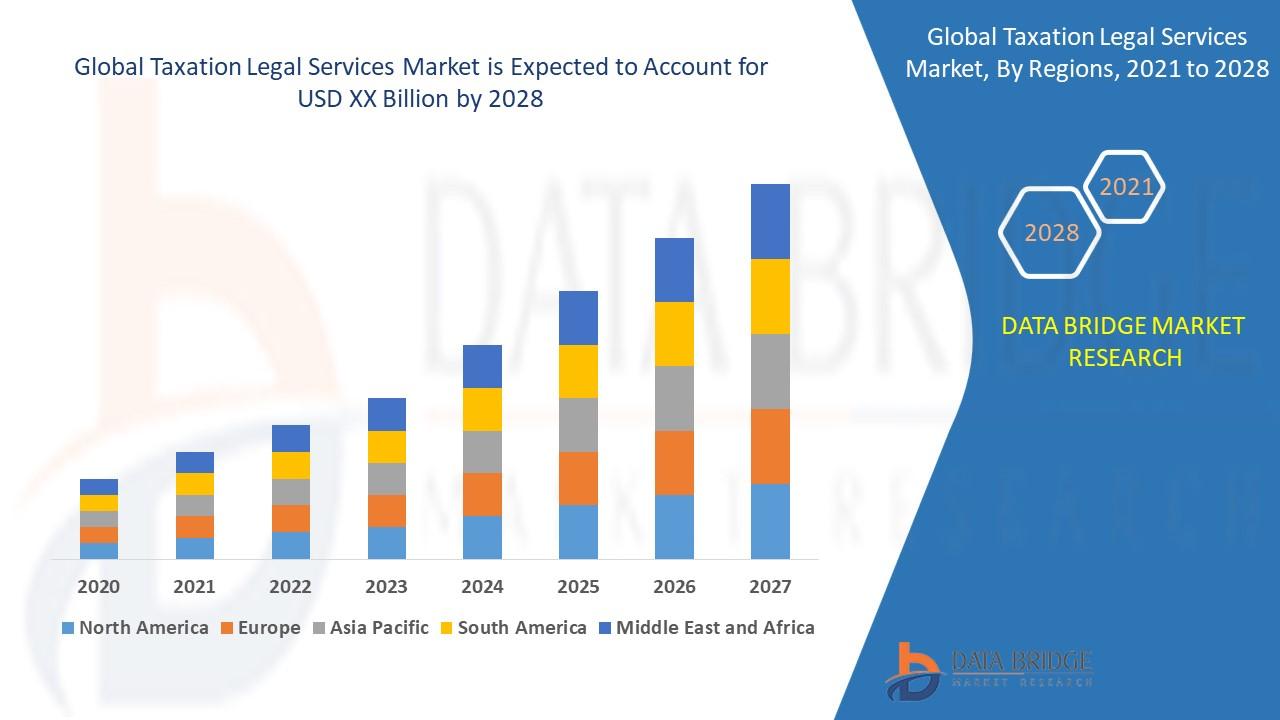

In the forecast period from 2021 to 2028, the taxation legal services market is projected to experience market growth of 4.10%.

Taxation Legal Services Market research report is a verified source of data and information that provides a telescopic view of the current market trends, situations, opportunities and status. These market research data analyses prime challenges faced by the Taxation Legal Services Market industry presently and in the coming years. The report gives CAGR (compound annual growth rate) value fluctuations for the specific forecasted period which is useful in deciding costing and investment strategies. It gives idea to other market participants about the problems that they might face while operating in this market over a longer period of time. Taxation Legal Services Market document is an explicit study of the Taxation Legal Services Market industry which explains what the market definition, classifications, applications, engagements, and global industry trends are.

The large scale Taxation Legal Services Market report makes available major statistics on the market status of global and regional manufacturers and is a supportive source for companies and individuals interested in the Taxation Legal Services Market industry. The company profiles of all the dominating market players and brands that are making moves such as product launches, joint ventures, mergers and acquisitions are described in the report. It also becomes easy to analyse the actions of key players and respective effect on the sales, import, export, revenue and CAGR values. Taxation Legal Services Marketing report is most suitable for business requirements in many ways.

Get a full overview of market dynamics, forecasts, and trends. Download the complete Taxation Legal Services Market report: https://www.databridgemarketresearch.com/reports/global-taxation-legal-services-market

Taxation Legal Services Market Summary

Segments

- Type of Services: The Global Taxation Legal Services Market can be segmented based on the type of services offered, including tax planning, tax dispute resolution, transfer pricing, compliance, and litigation support among others. Tax planning services help businesses and individuals strategize their financial affairs to minimize tax liabilities. Tax dispute resolution involves representing clients in disputes with tax authorities. Transfer pricing services help multinational companies establish appropriate prices for transactions among their different divisions. Compliance services ensure that businesses are following all tax laws and regulations. Litigation support services involve providing legal assistance in tax-related court cases.

- End-User: Another important segmentation in the Global Taxation Legal Services Market is based on end-users, including individuals, small and medium-sized enterprises (SMEs), and large corporations. Individuals often seek taxation legal services for personal tax planning, estate planning, and resolving tax disputes with authorities. SMEs require taxation legal services to navigate complex tax laws and regulations, ensure compliance, and optimize tax efficiency. Large corporations often require sophisticated tax planning strategies, transfer pricing assistance, and global tax compliance services.

- Region: Geographically, the Global Taxation Legal Services Market can be segmented into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa. Each region has its unique tax regulations and legal frameworks, which drive the demand for specialized taxation legal services. North America and Europe are mature markets with established legal systems and complex tax codes. Asia Pacific is a fast-growing region with increasing regulatory requirements and cross-border tax implications. Latin America and Middle East & Africa present diverse market dynamics with evolving tax landscapes.

Market Players

- Deloitte Touche Tohmatsu Limited

- PricewaterhouseCoopers (PwC)

- Ernst & Young Global Limited

- KPMG International

- Baker McKenzie

- Skadden, Arps, Slate, Meagher & Flom LLP

- DLA Piper

- Latham & Watkins LLP

- Allen & Overy LLP

- Clifford Chance LLP

The Global Taxation Legal Services Market is experiencing significant growth due to the increasing complexities in tax laws and regulations worldwide. One emerging trend in the market is the rising demand for specialized tax planning services, particularly among multinational corporations looking to optimize their tax structures and ensure compliance with evolving regulations. This trend is driven by the need for businesses to adapt to changing tax landscapes and navigate cross-border tax implications effectively. As tax authorities strengthen their enforcement capabilities, the demand for expert tax dispute resolution services is also on the rise, with companies and individuals seeking legal support to resolve disputes efficiently.

Furthermore, the market is witnessing a shift towards technology-driven solutions in taxation legal services. With the increasing use of automation and artificial intelligence in the industry, market players are incorporating digital tools to enhance efficiency in tax planning, compliance, and litigation support services. Technology is enabling firms to analyze vast amounts of data quickly, identify tax saving opportunities, and ensure accurate compliance with tax laws. This digital transformation is reshaping the delivery of taxation legal services and enabling firms to provide more tailored and cost-effective solutions to their clients.

In addition, the globalization of businesses is driving the demand for transfer pricing services in the Global Taxation Legal Services Market. Multinational companies operating in multiple jurisdictions require assistance in setting arm's length prices for intercompany transactions to comply with transfer pricing regulations and avoid disputes with tax authorities. Transfer pricing services play a crucial role in helping companies manage their tax risks effectively and optimize their tax positions globally. As cross-border transactions become more common, the need for transfer pricing expertise is expected to grow, presenting opportunities for market players specializing in this area.

Moreover, the increasing focus on sustainability and corporate social responsibility is shaping the landscape of taxation legal services. Companies are facing growing pressure to report their tax practices transparently and ethically, aligning with societal expectations for responsible business conduct. Market players are responding to this trend by offering services that promote tax transparency, ethical tax planning, and compliance with environmental, social, and governance (ESG) principles. By assisting clients in integrating sustainable tax practices into their business operations, legal service providers can add value and differentiate themselves in the market.The Global Taxation Legal Services Market is characterized by increasing complexities in tax laws and regulations worldwide, leading to significant growth opportunities for market players. One of the key trends driving this market is the rising demand for specialized tax planning services, particularly from multinational corporations seeking to optimize their tax structures and ensure compliance with evolving regulations. As businesses aim to adapt to changing tax landscapes and navigate cross-border tax implications effectively, the need for expert tax dispute resolution services is also on the rise. Companies and individuals alike are turning to legal support to efficiently resolve tax-related disputes in a timely manner.

Moreover, there is a notable shift towards technology-driven solutions within the taxation legal services sector. The adoption of automation and artificial intelligence tools is enhancing efficiency in tax planning, compliance, and litigation support services. By leveraging digital solutions, market players are better equipped to analyze large volumes of data rapidly, identify tax-saving opportunities, and ensure precise compliance with tax laws. The integration of technology into service offerings is reshaping how taxation legal services are delivered, enabling firms to provide more customized and cost-effective solutions to their clients.

The globalization of businesses is also a significant driver shaping the Global Taxation Legal Services Market, particularly in the area of transfer pricing services. Multinational companies operating across various jurisdictions require guidance in setting arm's length prices for intercompany transactions to comply with transfer pricing regulations and prevent disputes with tax authorities. Transfer pricing services play a critical role in helping companies effectively manage their tax risks and optimize their tax positions on a global scale. With cross-border transactions becoming increasingly prevalent, the demand for transfer pricing expertise is expected to rise, creating opportunities for market players specializing in this domain.

Furthermore, the growing emphasis on sustainability and corporate social responsibility is influencing the landscape of taxation legal services. Companies are under mounting pressure to transparently and ethically report their tax practices, aligning with societal expectations for responsible business conduct. Market players are addressing this trend by offering services that promote tax transparency, ethical tax planning, and compliance with environmental, social, and governance (ESG) principles. By assisting clients in integrating sustainable tax practices into their business operations, legal service providers can contribute value and set themselves apart in the market.

Examine the market share held by the company

https://www.databridgemarketresearch.com/reports/global-taxation-legal-services-market/companies

Taxation Legal Services Market Research Questionnaire – 25 Sets of Analyst Questions

- How large is the addressable market in the Taxation Legal Services Market sector?

- What is the estimated revenue forecast for the next 5 years?

- What are the key distribution channels in the Taxation Legal Services Market?

- Which demographics contribute most to demand?

- How does product innovation influence Taxation Legal Services Market competitiveness?

- What is the level of brand loyalty in the Taxation Legal Services Market?

- What barriers are hindering Taxation Legal Services Market growth?

- How are key players differentiating their offerings?

- What geographic trends are shaping the Taxation Legal Services Market?

- How do raw material prices affect profit margins?

- What is the impact of social media Taxation Legal Services Market?

- Which export markets are growing for this Taxation Legal Services Market industry?

- What are the sustainability concerns in the sector?

- Are local brands outperforming global Taxation Legal Services Market ones?

Browse More Reports:

Global Potassium Nitrate Market

Global Potato Starch Market

Global Prestressed Concrete Wire and Strand Market

Global Queue Management System Market

Global Radiation Oncology Treatment Planning Software Market

Global Radiology Services Market

Global Rapid Oral Fluid Screening Device Market

Global Ready to Assemble (RTA) Furniture Market

Global Ready to Drink Coffee Market

Global Ribavirin Market

Global Robo-Taxi Market

Global Satellite Service Market

Global Smart Beacon Market

Global Sodium Silicate Market

Global Stevia Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- [email protected]

"

- Books

- Software

- Gruppen

- Filme

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Spiele

- Gardening

- Health

- Startseite

- Literature

- Music

- Networking

- Andere

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness