-

Nieuws Feed

- EXPLORE

-

Pagina

-

Groepen

-

Reels

-

Blogs

-

Developers

How the Faster Payment Service (FPS) Market Is Transforming Global Digital Transactions in 2025

Introduction

The Faster Payment Service (FPS) Market represents a transformative shift in the financial services landscape. Designed to enable near-instantaneous fund transfers between banks and financial institutions, FPS has revolutionized the way consumers, businesses, and governments handle monetary transactions. As digital transformation accelerates globally, the need for real-time payment systems has become crucial for economic efficiency and financial inclusion.

Over the past decade, the Faster Payment Service Market has grown rapidly due to the surge in digital transactions, increasing smartphone penetration, and rising e-commerce activities. Consumers now demand immediacy, transparency, and security in payments—qualities that FPS provides. Governments and financial institutions across the globe are adopting and enhancing faster payment infrastructures to support real-time economies. With the shift toward cashless societies, the FPS market continues to expand as a core component of modern payment ecosystems.

Stay ahead with crucial trends and expert analysis in the latest Faster Payment Service (FPS) Market report. Download now: https://www.databridgemarketresearch.com/reports/global-faster-payment-service-fps-market

Market Overview

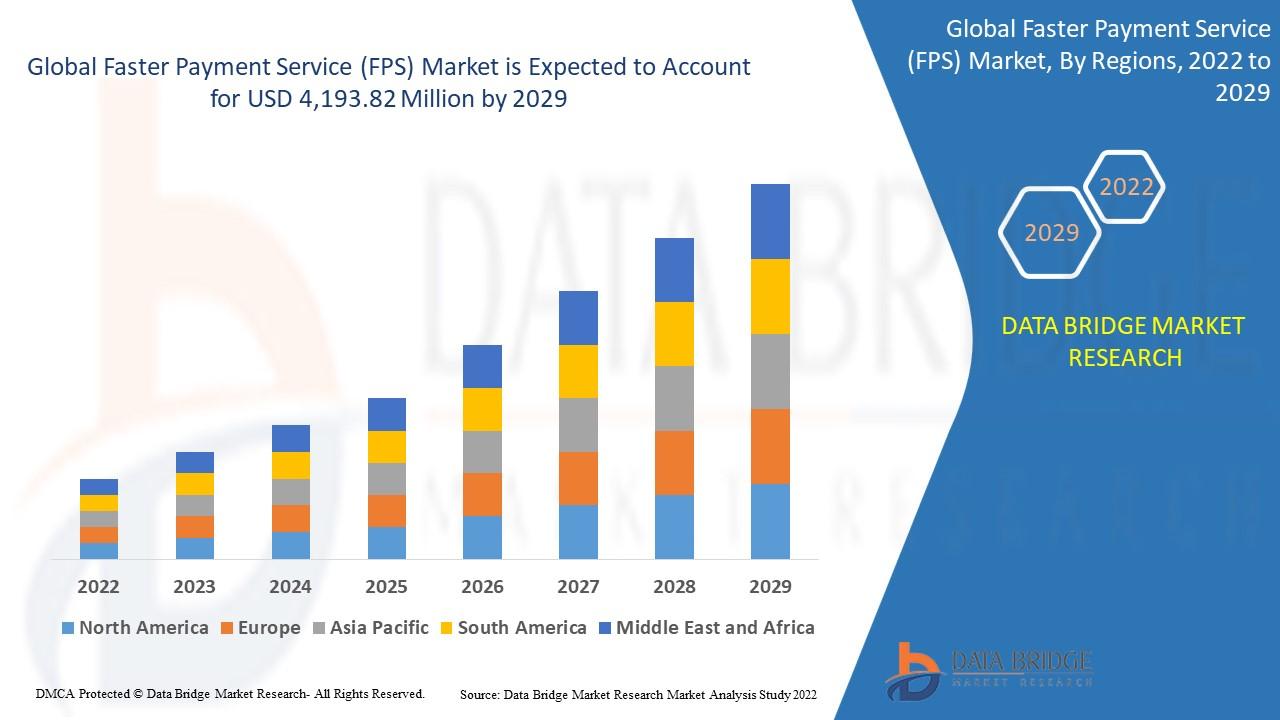

The global Faster Payment Service (FPS) Market has witnessed substantial growth in recent years. Initially introduced in the United Kingdom in 2008, the concept has since been adopted worldwide. As of 2025, more than 60 countries have launched or are developing faster payment systems. The market’s value is expected to continue rising, driven by digital banking adoption, cross-border payment modernization, and increased consumer preference for instant payments.

Regions such as North America, Europe, and Asia-Pacific are at the forefront of this expansion. In Asia-Pacific, particularly in countries like India, China, and Singapore, real-time payment networks have already become integral to daily transactions. In Europe, regulatory frameworks such as PSD2 and SEPA Instant Credit Transfer have accelerated FPS adoption. Meanwhile, North America has seen rapid development through initiatives like The Clearing House’s Real-Time Payments (RTP) network and the U.S. Federal Reserve’s FedNow system.

The Faster Payment Service Market is projected to grow at a strong compound annual growth rate (CAGR) over the next decade, fueled by both public and private sector efforts to achieve financial interoperability and instant money transfer solutions.

Key Market Drivers

-

Digital Transformation and Fintech Growth

The increasing digitalization of financial services has been a significant catalyst for FPS adoption. Fintech startups and digital banks are leveraging FPS infrastructure to offer customers faster, cheaper, and more transparent payment options. -

Consumer Demand for Instant Payments

In a fast-paced digital economy, customers expect real-time transactions for online shopping, bill payments, and peer-to-peer transfers. This demand is pushing financial institutions to adopt faster payment systems to stay competitive. -

Government and Regulatory Support

Many governments are encouraging faster payment systems to promote financial inclusion and boost economic efficiency. Central banks are collaborating with payment providers to build secure, interoperable networks that enhance liquidity and transparency. -

Rise of E-commerce and Mobile Payments

The explosive growth of online retail and mobile commerce has intensified the need for real-time payments. FPS supports immediate settlement between buyers and sellers, reducing delays and improving transaction confidence. -

Technological Advancements

Emerging technologies like blockchain, artificial intelligence, and cloud computing are enhancing payment security, speed, and scalability. These innovations are helping financial institutions integrate FPS systems more efficiently.

Market Segmentation

The Faster Payment Service (FPS) Market can be segmented by component, application, deployment, and end-user.

-

By Component

-

Solutions: Includes payment gateways, real-time transaction platforms, and clearing systems.

-

Services: Encompasses implementation, consulting, and maintenance services that ensure smooth operations.

-

-

By Application

-

Retail Payments: Used for online purchases, peer-to-peer transfers, and utility payments.

-

Corporate Payments: Supports business-to-business (B2B) transactions, payroll disbursements, and vendor payments.

-

Government Payments: Used for tax refunds, subsidies, and social benefits.

-

-

By Deployment Mode

-

Cloud-based: Gaining traction due to scalability, cost-efficiency, and easy integration.

-

On-premise: Preferred by large banks for enhanced security and control.

-

-

By End-User

-

Banks and Financial Institutions: The primary adopters of FPS solutions.

-

Fintech Companies: Driving innovation in real-time payment technologies.

-

E-commerce Companies: Using FPS for seamless checkout experiences.

-

Among these, the retail payment segment holds the largest share due to the growing consumer demand for instant payment solutions in everyday transactions. Cloud-based deployment is expected to witness the fastest growth as institutions transition toward digital infrastructure.

Competitive Landscape

The Faster Payment Service Market is highly competitive, featuring a mix of established payment networks, technology providers, and emerging fintech innovators. Key players in the industry include Mastercard, Visa, PayPal, FIS, ACI Worldwide, The Clearing House, Temenos, and Ripple Labs.

These companies are continuously investing in research and development to enhance transaction speed, security, and interoperability. Strategic collaborations between banks and fintech firms are becoming increasingly common to expand reach and improve user experience. For instance, partnerships between technology providers and central banks have led to the creation of robust, real-time payment systems like India’s Unified Payments Interface (UPI) and the UK’s Faster Payments Service.

Mergers and acquisitions are also reshaping the competitive dynamics, enabling companies to integrate advanced technologies and expand globally. The emphasis on innovation, cybersecurity, and customer experience continues to define success in this evolving market.

Challenges and Restraints

Despite strong growth potential, the Faster Payment Service Market faces several challenges:

-

Cybersecurity Concerns

As payment transactions occur in real time, there is less time to detect and prevent fraud. This requires robust security infrastructure and constant monitoring. -

High Implementation Costs

Setting up a faster payment infrastructure can be expensive, particularly for small financial institutions that lack technological resources. -

Regulatory and Compliance Issues

Variations in regional regulations can hinder interoperability between countries. Compliance with anti-money laundering (AML) and know-your-customer (KYC) standards remains a major concern. -

Integration Complexity

Integrating faster payment systems with legacy banking platforms can be challenging, especially for traditional banks with outdated infrastructure. -

Consumer Awareness and Trust

In some developing regions, limited awareness about real-time payment benefits can slow adoption. Educating users about safety and reliability is crucial for long-term growth.

Future Outlook

The future of the Faster Payment Service Market looks highly promising. With continued investments in digital banking infrastructure, cross-border payment systems are expected to evolve, creating a unified global payment ecosystem. The introduction of Central Bank Digital Currencies (CBDCs) will further complement FPS systems, enhancing transaction transparency and traceability.

Artificial intelligence and data analytics will play a vital role in detecting fraud and optimizing payment processing efficiency. Meanwhile, open banking initiatives will allow fintech companies to access bank data securely, fostering innovation in instant payment applications.

Emerging economies in Latin America and Africa are also expected to experience significant growth as governments prioritize financial inclusion and digital payment reforms. As businesses and consumers continue to demand faster, safer, and more reliable payment options, FPS will remain at the core of digital financial transformation.

Conclusion

The Faster Payment Service (FPS) Market stands at the intersection of technology, finance, and innovation. Its ability to provide instantaneous, secure, and transparent payment solutions is transforming the global economy. As digitalization accelerates, FPS is becoming indispensable for individuals, businesses, and governments seeking seamless financial interactions.

With continuous advancements in technology and growing support from regulators, the FPS market is poised for long-term expansion. By overcoming challenges related to security, regulation, and infrastructure, the industry is set to redefine how money moves across the world.

Frequently Asked Questions (FAQs)

1. What is the growth rate of the Faster Payment Service Market?

The Faster Payment Service Market is projected to grow at a strong CAGR over the next decade, driven by digital transformation, regulatory support, and consumer demand for real-time transactions.

2. Which region is expected to dominate the Faster Payment Service Market in the future?

Asia-Pacific is expected to lead the market due to the rapid adoption of real-time payment systems in countries such as India, China, and Singapore.

3. Who are the leading players in the Faster Payment Service Market?

Key players include Mastercard, Visa, PayPal, ACI Worldwide, FIS, The Clearing House, and Ripple Labs. These companies are at the forefront of innovation and infrastructure development.

4. What are the major challenges faced by the Faster Payment Service Market?

Challenges include cybersecurity threats, high implementation costs, regulatory hurdles, and integration complexities with legacy systems.

5. What are the future opportunities in the Faster Payment Service Market?

Future opportunities lie in cross-border payment innovation, integration with digital currencies, AI-driven fraud prevention, and expanding financial inclusion in emerging markets.

6. How do Faster Payment Services benefit businesses and consumers?

They provide instant transaction settlement, improved liquidity management, enhanced customer satisfaction, and reduced operational delays for both businesses and individuals.

7. What role do governments play in promoting Faster Payment Services?

Governments and central banks are actively supporting faster payment infrastructures to ensure secure, inclusive, and efficient payment systems that strengthen economic growth.

Browse More Reports:

Global Sealed Lead Acid Battery Market

Global Seborrheic Keratosis Market

Global Security Monitoring Proactive Market

Global Seed Coating Materials Market

Global Self Cleaning Filters Market

Global Self-Monitoring of Blood Glucose (SMBG) Market

Global Semi Anechoic Chamber Market

Global Semiconductor Packaging Materials Market

Global Shale Gas Market

Global Shape Memory Alloy Market

Global Sialorrhea Market

Global Silent Thyroiditis Market

Global Silicon Based Paper Market

Global Simultaneous Voice and LTE (SVLTE) Market

Global Skin and Skin Structure Infections (SSSI) (Infectious Disease) Treatment Market

Global Skin Care Devices Market

Global Skin Lightening Products Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- [email protected]

- Faster_payment_systems

- instant_bank_transfers

- digital_payment_innovation

- financial_technology_growth

- payment_infrastructure_market

- FPS_adoption_trends

- secure_digital_transactions

- fintech_modernization

- cross-border_instant_payments

- payment_service_providers

- digital_banking_evolution

- API-based_payments

- cashless_economy_shift

- real-time_settlement_market

- future_of_banking_payments

- Books

- Software

- Courses

- Movies

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Spellen

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness