-

Newsfeed

- ERKUNDEN

-

Seiten

-

Gruppen

-

Blogs

-

Entwickler

Can Faster Payment Services Redefine the Way We Trust and Move Money Globally?

Executive Summary Faster Payment Service (FPS) Market Size and Share Analysis Report

CAGR Value

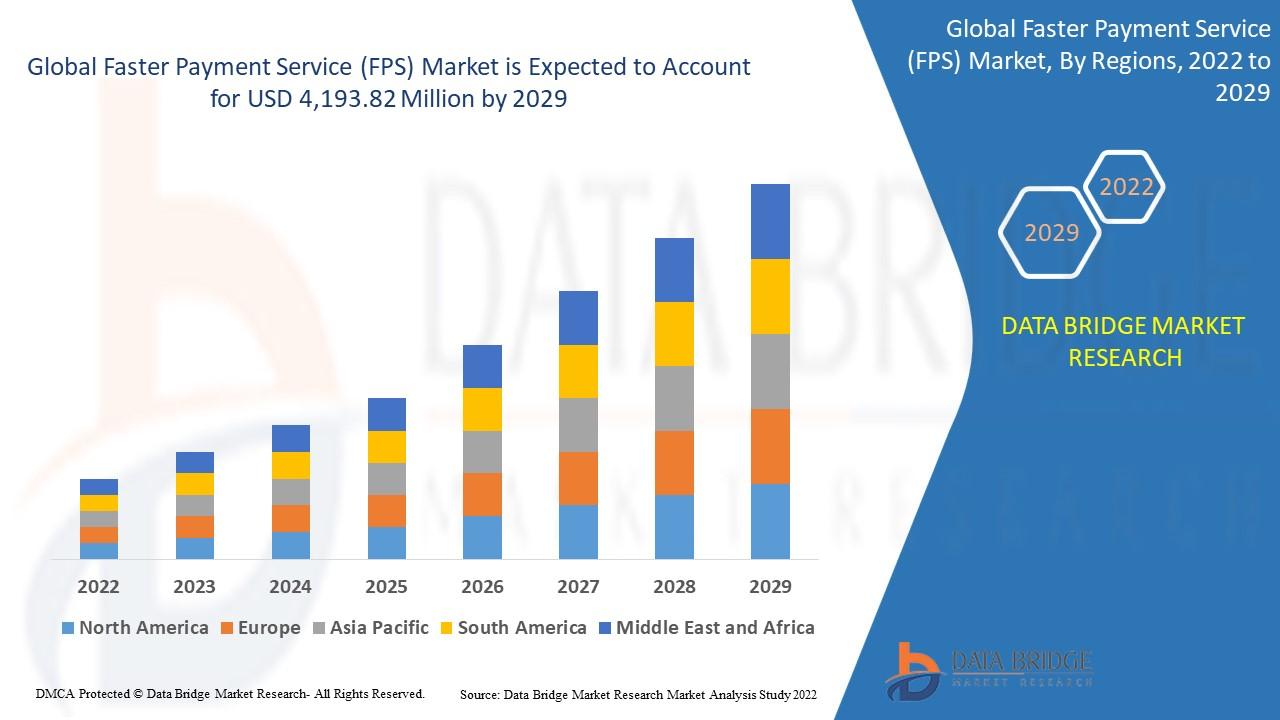

Global faster payment service (FPS) market was valued at USD 543.5 million in 2021 and is expected to reach USD 4,193.82 million by 2029, registering a CAGR of 29.10% during the forecast period of 2022-2029.

Businesses are very much depending on the diverse segments involved in the market research report as it offers better insights to drive the business on the right track. Market reports are acquiring huge importance in this speedily transforming market place; hence Faster Payment Service (FPS) Market report has been endowed in a way that is anticipated. It provides noteworthy data, current market trends, future events, market environment, technological innovation, approaching technologies and the technical progress in the relevant industry. The information and data quoted in Faster Payment Service (FPS) Market business report is gathered from the truthful sources such as websites, journals, mergers, and annual reports of the companies.

Moreover, the winning Faster Payment Service (FPS) Market report analyses the common market conditions such as product price, profit, capacity, production, supply, demand, and market growth rate which lends a hand to businesses on deciding upon several strategies. Major market players, major collaborations, merger, acquisitions, trending innovation and business policies are also re-evaluated in the report. SWOT analysis has been carried out throughout the report while formulating it along with many other standard steps of researching, analysing and collecting data. It becomes easy to figure out brand awareness and view about the brand and product among potential customers. The comprehensive Faster Payment Service (FPS) Market report presents actionable market insights with which businesses can settle on sustainable and lucrative strategies.

Explore emerging trends, key drivers, and market strategies in our in-depth Faster Payment Service (FPS) Market analysis. Get the full report: https://www.databridgemarketresearch.com/reports/global-faster-payment-service-fps-market

Faster Payment Service (FPS) Market Insights:

Segments

- Service Type: The global Faster Payment Service market can be segmented based on service type into real-time payments, immediate payments, and same-day payments. Real-time payments are gaining popularity due to the need for instant transactions in today's fast-paced digital world. Immediate payments are also seeing significant growth as consumers and businesses seek rapid payment processing. Same-day payments cater to those looking for faster settlement times compared to traditional payment methods.

- Deployment: Deployment segments in the Faster Payment Service market include cloud-based and on-premises solutions. Cloud-based deployments offer scalability and flexibility, making them a preferred choice for many organizations. On-premises solutions provide greater control and customization but may require higher initial investment and maintenance costs.

- End-User: The market can also be segmented by end-user, including banks, financial institutions, ecommerce platforms, retail sector, and others. Banks and financial institutions are early adopters of Faster Payment Services to enhance customer experience and stay competitive in the market. Ecommerce platforms and the retail sector are increasingly utilizing FPS to streamline transactions and improve efficiency.

Market Players

- Mastercard: Mastercard offers Faster Payment solutions to enable real-time payment processing for businesses and consumers globally. Their innovative platforms help facilitate seamless transactions and improve payment experiences.

- Visa Inc.: Visa Inc. provides secure and efficient Faster Payment Service options for a wide range of industries, including banking, retail, and technology. Their advanced payment solutions ensure fast and reliable transactions for customers around the world.

- PayPal Holdings, Inc.: PayPal is a leading player in the global Faster Payment Service market, offering secure payment options for online transactions. Their user-friendly platforms and robust security features make them a trusted choice for individuals and businesses.

- Fiserv, Inc.: Fiserv offers comprehensive Faster Payment solutions for financial institutions and businesses looking to enhance their payment processing capabilities. Their advanced technology and industry expertise make them a key player in the FPS market.

- Ant Financial Services Group: Ant Financial Services Group provides innovative Faster Payment Service solutions through platforms like Alipay, catering to the growing demand for fast and secure transactions in the digital economy.

The global Faster Payment Service market is experiencing rapid growth and evolution, driven by the increasing demand for quick and efficient payment solutions. Companies like Mastercard, Visa Inc., PayPal Holdings, Inc., Fiserv, Inc., and Ant Financial Services Group are at the forefront of this market, offering innovative services to meet the needs of consumers and businesses worldwide. As technology continues to advance, the FPS market is expected to expand further, providing seamless payment experiences and driving greater financial inclusion.

Various factors are contributing to the rapid growth of the global Faster Payment Service (FPS) market. One key driver is the increasing focus on digital transformation across industries, leading to a greater emphasis on real-time payment processing. The need for immediate transactions in today's fast-paced environment is pushing businesses and consumers towards adopting faster payment solutions to meet their evolving needs. This shift towards instant payments is fueled by the growing preference for convenience, efficiency, and seamless transaction experiences.

Moreover, the rise of e-commerce and the digital economy is playing a significant role in shaping the FPS market landscape. With the continuous growth of online shopping and digital transactions, there is a growing demand for secure and efficient payment solutions that can enable quick and hassle-free payments. Businesses operating in the e-commerce sector are particularly keen on leveraging FPS to streamline their payment processes, reduce transaction times, and enhance overall customer satisfaction.

Another factor driving the evolution of the FPS market is the increasing competition among financial institutions and payment service providers. To stay ahead in the market and meet the changing demands of customers, banks and financial institutions are investing in Faster Payment Services to offer real-time payment capabilities and improve their service offerings. This competitive landscape is leading to technological innovations and partnerships aimed at delivering faster, more secure, and reliable payment solutions to users.

Furthermore, regulatory initiatives and industry standards are also shaping the FPS market dynamics. Regulatory bodies are increasingly focusing on promoting faster and more efficient payment systems to foster financial inclusion, enhance transparency, and mitigate fraud and operational risks. Compliance with regulatory requirements and adherence to industry standards are becoming crucial for players in the FPS market to ensure trust, security, and seamless interoperability across different payment networks.

Overall, the global Faster Payment Service market is witnessing a paradigm shift towards instant, secure, and customer-centric payment solutions. The market players mentioned earlier, including Mastercard, Visa Inc., PayPal Holdings, Inc., Fiserv, Inc., and Ant Financial Services Group, are well-positioned to capitalize on this trend by offering innovative services that cater to the evolving needs of businesses and consumers. As the market continues to evolve, collaboration, technological advancements, and a customer-centric approach will be key differentiators for companies looking to succeed in the dynamic and competitive FPS landscape.The global Faster Payment Service market is experiencing robust growth driven by various factors. One significant driver is the increasing shift towards digital transformation across industries, emphasizing the need for real-time payment processing capabilities. Businesses and consumers are seeking instant transactions to meet the demands of today's fast-paced digital environment, leading to a rise in the adoption of faster payment solutions. The growing preference for convenience, efficiency, and seamless payment experiences is further fueling the demand for instant payment options.

Additionally, the expansion of e-commerce and the digital economy is significantly impacting the FPS market landscape. The continuous growth of online shopping and digital transactions is propelling the need for secure and efficient payment solutions that can facilitate quick and hassle-free payments. E-commerce businesses are particularly inclined towards leveraging FPS to streamline their payment processes, reduce transaction times, and enhance overall customer satisfaction in a highly competitive market.

Moreover, the intensifying competition among financial institutions and payment service providers is driving the evolution of the FPS market. To remain competitive and meet the evolving customer demands, banks and financial entities are investing in Faster Payment Services to offer real-time payment capabilities and enhance their service offerings. This competitive environment is fostering technological innovations and strategic partnerships focused on delivering faster, secure, and reliable payment solutions to users.

Regulatory initiatives and industry standards also play a pivotal role in shaping the dynamics of the FPS market. Regulatory bodies are increasingly pushing for faster and more efficient payment systems to promote financial inclusion, enhance transparency, and mitigate risks such as fraud and operational challenges. Compliance with regulatory mandates and adherence to industry standards have become crucial for FPS market players to ensure trust, security, and seamless interoperability across diverse payment networks.

In conclusion, the global Faster Payment Service market is undergoing a transformation towards instant, secure, and customer-centric payment solutions. Key market players such as Mastercard, Visa Inc., PayPal Holdings, Inc., Fiserv, Inc., and Ant Financial Services Group are well-positioned to leverage this trend by offering innovative services that cater to the evolving needs of businesses and consumers worldwide. Collaboration, technological advancements, and a strong focus on customer experience will be instrumental in driving success in the dynamic and competitive FPS landscape.

Explore the company's market share breakdown

https://www.databridgemarketresearch.com/reports/global-faster-payment-service-fps-market/companies

Comprehensive Question Bank for Faster Payment Service (FPS) Market Research

- What is the current market size of the Faster Payment Service (FPS) Market?

- What is the expected growth rate of the Faster Payment Service (FPS) Market?

- What are the primary segments covered in the Faster Payment Service (FPS) Market report?

- Who are major players in the Faster Payment Service (FPS) Market?

- What are the recent product launches by major companies in the Faster Payment Service (FPS) Market?

- Which countries’ data is covered in the Faster Payment Service (FPS) Market?

- Which is the fastest-growing region in the Faster Payment Service (FPS) Market?

- Which country is expected to dominate in the Faster Payment Service (FPS) Market?

- Which region has the largest share in the Faster Payment Service (FPS) Market?

- Which country is expected to witness the highest CAGR in the Faster Payment Service (FPS) Market?

- What are the key trends in the Faster Payment Service (FPS) Market?

- What are the factors driving the Faster Payment Service (FPS) Market growth?

- What are the major challenges in the Faster Payment Service (FPS) Market?

- Which is the dominating segment in the Faster Payment Service (FPS) Market?

Browse More Reports:

Global Infant Incubator Market

Global Infectious Mononucleosis Market

Global Inflatable Pillow Market

Global Injectable Nanomedicine Market

Global Intelligent Power Module Market

Global Intermodal Transportation Market

Global International Standards Organisation (ISO) Shipping Container Market

Global Interventional Cardiology and Peripheral Vascular Devices Market

Global Intrinsically Safe Equipment Market

Global Iris Retractor Market

Global Iron Ore Pellet Market

Global Irradiation Apparatus Market

Global Kallmann Syndrome Market

Global Keto-friendly Products Market

Global Kids Travel Bags Market

Global Kinase Inhibitors Market

Global Keyboard, Video and Mouse (KVM) Switch Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- [email protected]

- Books

- Software

- Gruppen

- Filme

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Spiele

- Gardening

- Health

- Startseite

- Literature

- Music

- Networking

- Andere

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness